Gold Price Prediction: 20 & 50 EMA Underpins Gold, Brace for Buying!

During Wednesday's Asian trading session, the safe-haven-metal failed to extend its previous-day winning streak and dropped from two-week hi

During Wednesday’s Asian trading session, the safe-haven-metal failed to extend its previous-day winning streak and dropped from two-week highs to the $1735 level mainly due to the upbeat market mood being supported by the extraordinary pace of coronavirus vaccinations. Meanwhile, U.S. President Joe Biden’s infrastructure spending plan of more than $2 trillion has played a significant role in underpinning market sentiment. The positive market sentiment was seen as one of the critical factors that undermined the GOLD price.

Apart from this, the previously released upbeat Chinese data, which shows a remarkable recovery in the world’s 2nd-largest economy, keeps market sentiment bullish, which weakens the safe-haven demand and contributes to losses in the yellow metal. Across the ocean, the stronger U.S. dollar was also bearish for the gold price as GOLD is inversely correlated to the price of the U.S. dollar.

The U.S. dollar saw some bids thanks to an uptick in U.S. Treasury bond yields. This, in turn, was seen as a leading factor that exerted some downside pressure on the dollar-denominated commodity. Alternatively, the long-lasting US-China tussle and cautious sentiment ahead of releasing the latest FOMC meeting minutes probes the risk-on mood, which may lend some support to the safe-haven gold. As of this writing, the yellow metal prices are currently trading at 1,738.89 and consolidating in the range between 1,735.91 – 1,744.40.

Despite the risk-on mood, the broad-based U.S. dollar managed to extend its previous-session winning streak and took some further bids on the day, possibly due to the upbeat U.S. data, which strengthened hopes for a quick economic recovery from COVID-19 and pushed the U.S. Treasury bond yields higher, which in turn, was seen as one of the key factors that underpin the U.S. dollar. However, the gains in the U.S. dollar was the key factor that kept the lid on any additional gains in the gold price as it is inversely correlated to the price of the U.S. dollar.

The losses in the gold prices could be short-lived as the growing anxieties between the U.S. and China probe the upbeat market mood. Meanwhile, the gold bulls may find some support also from the ongoing concerns about rising COVID-19 cases and renewed lockdowns in France and India.

In the absence of the major data/events on the day, traders will keep their eyes on releasing the latest FOMC meeting minutes, which is due later in the day. Meanwhile, chairman Jerome Powell’s remarks at a panel about the global economy will also be worth watching.

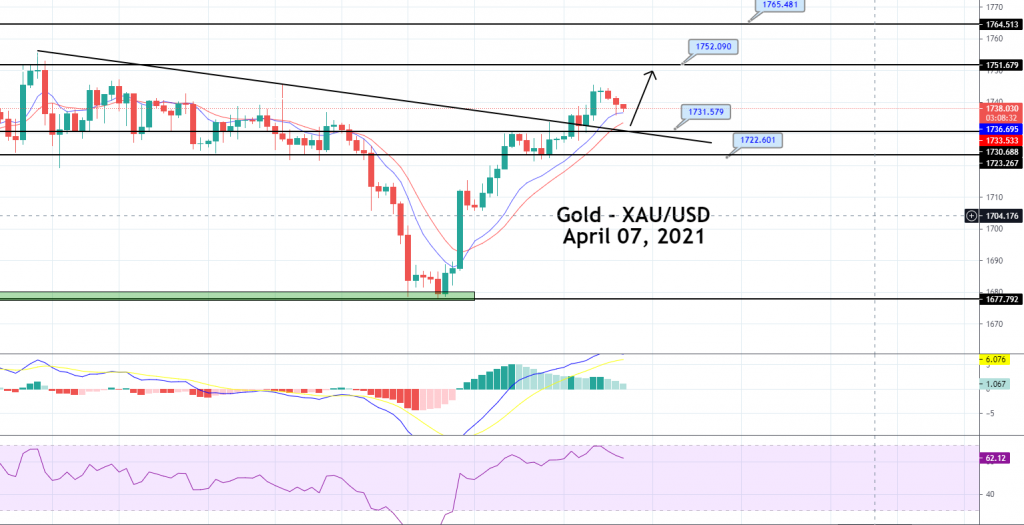

S1 1702.46

S2 1714.93

S3 1721.12

Pivot Point 1727.39

R1 1733.59

R2 1739.86

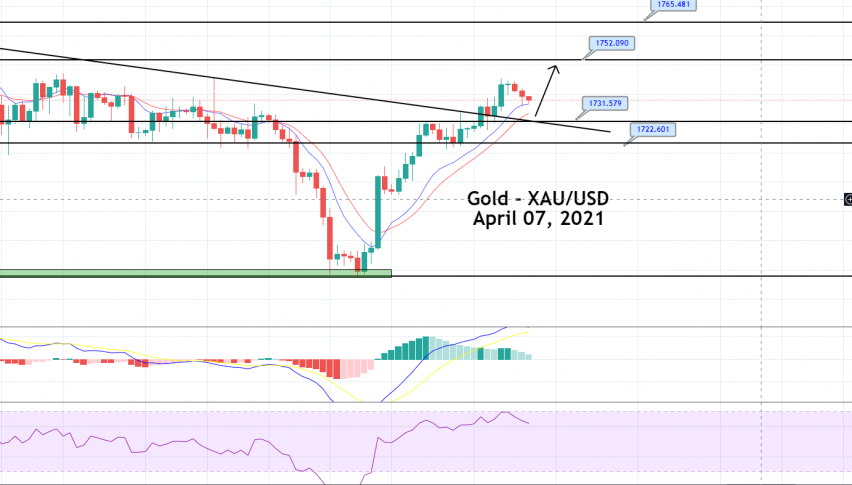

R3 1752.32GOLD is trading with a bullish bias at the 1,736 level, facing immediate resistance at the 1,744 level. The precious metal has violated the downward trendline on the two-hourly timeframes extending resistance at 1,733 level. For now, the closing of candles above 1,733 level is supporting the bullish bias. Bullish crossover at the 1,738 level can extend the buying trend until the next target area of 1,746 and 1,751 level. The 20 & 50 periods EMA support buying trends, along with the MACD and RSI, which are supporting bullish bias. Let’s now keep an eye on 1,738 as below this GOLD can exhibit selling and buying above the same level today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account