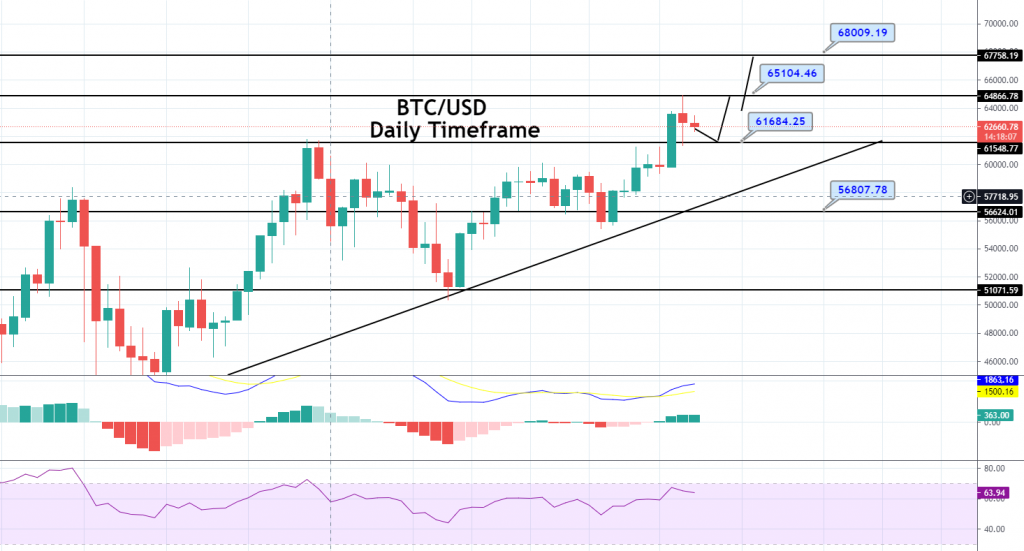

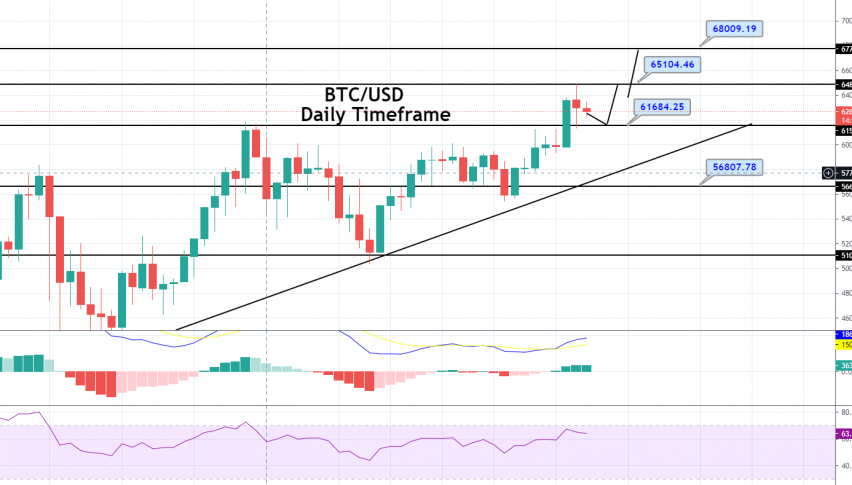

Bitcoin Price Forecast – BTC Completes Retracement, Can It Bounce Off Over 61,684?

The BTC/USD crypto pair failed to extend its overnight bullish streak but remained in a positive zone above the $63,000 level. It traded to

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

The BTC/USD crypto pair failed to extend its overnight bullish streak but remained in a positive zone above the $63,000 level. It traded to a new all-time top at $64,892 before it started a downside correction. As of writing, the BTC price is trading around $62,775.3. However, the buyers are gaining control of the market. It is essential to understand that the market is still looking for further upside in the near to mid-term because the gap has not been filled.

Suppose the buyers can succeed in breaking above the upper boundary of the channel. In that case, the next buying pressure can be expected at $69,000, $71,000, and possibly $73,000 resistance as the market is currently testing below the 70-level of the daily RSI (14). Conversely, the bounce below the moving averages could push Bitcoin (BTC) to $57,000, $55,000, and $53,000 supports.

BTC/USD Daily Support and Resistance

S2 59483.73

S3 61166.07

Pivot Point 63014.03

R1 64696.37

R2 66544.33

R3 70074.63

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account