USD/CAD Continues the Decline, As the Canadian Economy Starts to Rebound

MAs are keeping USD/CAD bearish now, as the USD decline resumes again

•

Last updated: Monday, April 19, 2021

[[USD/CAD-sponsored]]

USD/CAD has been bearish for more than a year, since it reversed down in March last year, following the decline in the USD. The bullish trend in crude Oil since April last year has fuelled this downside momentum in USD/CAD further, sending the price around 23 cents down from top to bottom.

Although, about a month ago we saw a retrace higher in this pair, which didn’t last very long though. The price moved above the 200 SMA (purple) several times, but it returned back down and now it has moved below all moving averages, which indicates that sellers have returned again. The Canadian economy is recovering now, despite the restrictions in certain places there, which is also helping the CAD.

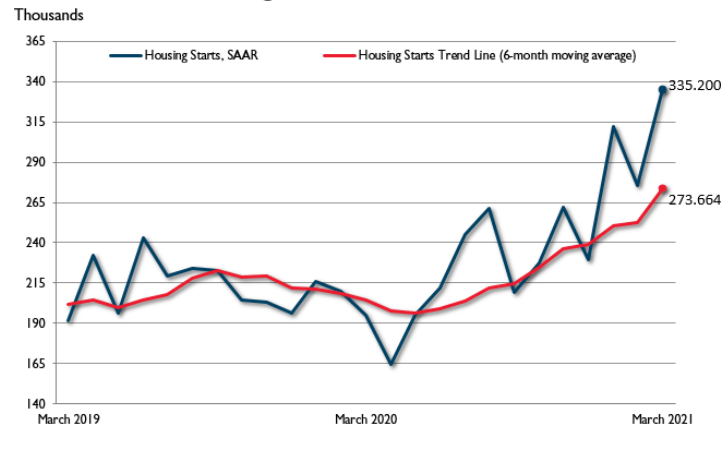

Canadian Housing Starts for March from the CMHC

- March housing starts 335K vs 255K expected

- Prior was 245.9K (revised to 275.5K)

- Multiple urban starts +33.8% m/m

- Single detached urban starts +3.6%

- Full report

“The national trend in housing starts increased in March, reflecting very elevated levels of activity in January and March 2021,” said Bob Dugan, CMHC’s chief economist. “Multi-family SAAR starts rebounded strongly following decline in February, with Toronto and Vancouver registering particularly large gains in this segment. Single-detached SAAR starts also contributed to the increase in the overall trend in March, but by a relatively modest amount in comparison to Multi-family starts.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.