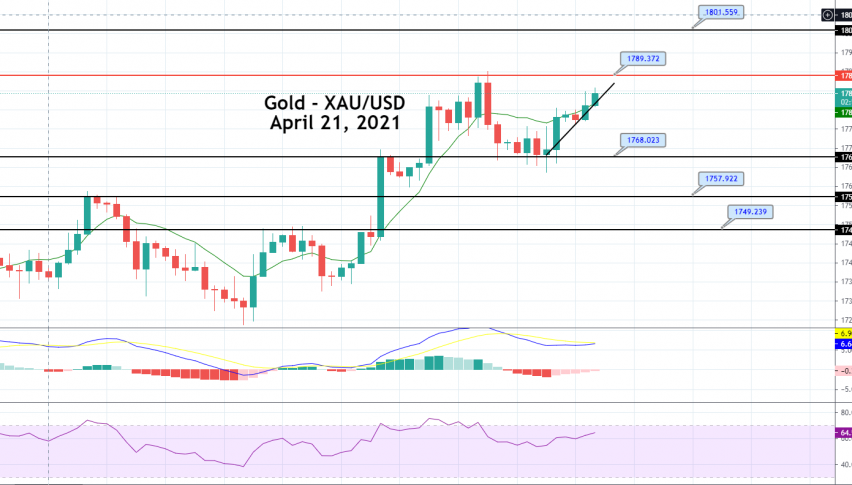

Gold Price Prediction: Bouncing Off Support, Heading For $1,789?

Today in Asian trading hours, the safe-haven-metal managed to extend its previous session heavy run-up and remained bullish around well abov

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Today in Asian trading hours, the safe haven metal managed to extend its previous session heavy run-up and remained bullish well above $1,780 marks. However, the prevalent buying bias was mainly sponsored by a coronavirus (COVID-19) resurgence, which dashes economic recovery hopes. The ever-increasing coronavirus cases in some major countries keep fueling the doubts over the economic recovery, which puts additional pressure on the market trading sentiment. The US-China and Russia-Ukraine tussle also played a significant role in undermining market trading sentiment, which lends further support to the safe haven metal.

Apart from this, the overall bearish tone surrounding the U.S. dollar tends to underpin the dollar-denominated commodity as the bearish U.S. dollar tends to make it cheaper for holders of other currencies to purchase the yellow metal. However, the U.S. dollar was being pressured by the speculations that the Fed will keep interest rates lower for an extended period. Conversely, the recently positive vaccine developments keep challenging the market’s risk-off sentiment, which was seen as one of the key factors that kept the lid on any additional gains in the yellow metal prices. As of writing, the yellow metal GOLD is trading at 1,780.45 and consolidating in the range between 1,776.35 and 1,784.76.

The global market sentiment failed to extend its previous day’s bullish performance. It turned sour on the day as the intensified coronavirus (COVID-19) fears raised doubts about global economic recovery. As per the latest report, India marked a record tally while Japan is set to reimpose the virus-led emergencies in Tokyo and surrounding areas. Moreover, the U.S. also tightens its border with Canada. In the meantime, the U.K. puts multiple countries, India included, in its “no travel” list, which immediately faded the optimism over the rollout of vaccines and contributed to the equity market losses. In simple words, the bearish appearance of the U.S. stock futures tends to highlight the risk-off sentiment, which tends to benefit the dollar-denominated commodity.The reason for the bearish market trading sentiment could also be associated with the renewed US-China, Russia-Ukraine geopolitical tension. Recently, the Dragon Nation gave a warning to the West not to interfere. Meanwhile, Russia keeps building an army near the border to Ukraine. Across the pond, the lack of guidance from the Fed ahead of next week’s meeting also exerted downside pressure on the market sentiment.

Despite the risk-off market sentiment, the broad-based U.S. dollar failed to gain any positive traction and dropped near a seven-week low amid speculations that the Fed will keep interest rates lower for a more extended period. However, the downticks in the USD become the critical factor that kept the gold prices higher as the price of bullion is inversely related to the price of the U.S. dollar. As of now, the U.S. Dollar Index that tracks the greenback against a bucket of other currencies was at 91.196 early in the Asian trading day after dropping as low as 90.856 on the previous day for the first time since March 3.

Given the lack of key data, the market traders will keep their eyes on the updates about the coronavirus (COVID-19). Meanwhile, risk catalyst like geopolitics issues will not lose their importance. The U.K.’s inflation and the Bank of Canada (BOC) monetary policy meeting will also offer fresh direction across the ocean.

Gold Daily Support and Resistance

S1 1729.21

S2 1752.68

S3 1762.06

Pivot Point 1776.14

R1 1785.53

R2 1799.61

R3 1823.07

GOLD is trading at 1,783 level, maintaining a broad trading range of 1,789 – 1,768. On the higher side, a bullish breakout of 1,789 level can extend buying trend until 1,801 level. The support continues to hold at 1,775 and 1,768 levels. It has closed a bullish engulfing candle on the 4-hour timeframe; therefore, the odds of bullish trend continuation seems solid today. At the same time, the MACD and RSI are also supporting a bullish trend in gold. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account