Ethereum Price Forecast – Bullish Trading Range, Good Time to Go Long?

ETH/USD closed at 2357.29 after placing a high of 2426.31 and a low of 2307.00. It extended its gains on Wednesday and reached above 2400

•

Last updated: Thursday, April 22, 2021

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

ETH/USD closed at 2357.29 after placing a high of 2426.31 and a low of 2307.00. ETH/USD extended its gains on Wednesday and reached above 2400 level amid the positive developments surrounding the Ethereum network and its usage. Following the Berlin hard fork, Ethereum miners have started to increase network capacity to 15 million gas. This was up from the year-long limit of around 12.5 million. The parent company of Ethermine, Bitfly, announced on Wednesday that the gas limits were being increased from 12.5 million TO 15 million. Meanwhile, the Canadian crypto ETF space was heating up as regulators approved three new Ether ETFs. The products resumed trading on the Toronto Stock Exchange on Tuesday, April 20. The three firms that had applied to launch Ethereum exchange-traded funds received approval from the Ontario Securities Commission.

The co-founder of crypto derivatives exchange BitMEX, Arthur Hayes, that once called Ethereum a double-digit shitcoin, now wished that he should have bought some ETH during the pre-sale in 2014 when the digital asset was sold for about 30 cents. Hayes asserted that Ethereum, along with many other cryptocurrency projects were a copy of BITCOIN. However, he believed that the world’s second-largest cryptocurrency offered a substantial improvement by creating a decentralized virtual computer that greatly expands the potential use cases for the technology underlying Bitcoin. Furthermore, ahead of the big rollout of Uniswap V3, the leading decentralized protocol has deployed its third iteration to all four Ethereum testnets. On Wednesday, Uniswap announced that its V3 core and periphery smart contracts had been deployed to four Ethereum testnets named Ropsten, Gorli, Kovan, and Rinkeby.

Ethereum Daily Technical Levels

Support Resistance

2202.76 2393.94

2075.31 2457.67

2011.58 2585.12

Pivot point: 2266.49

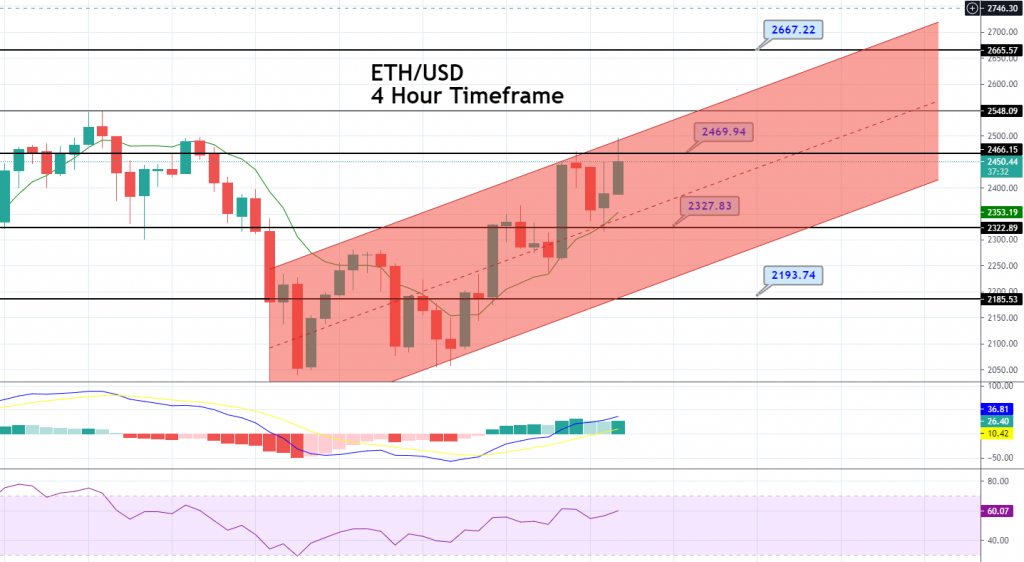

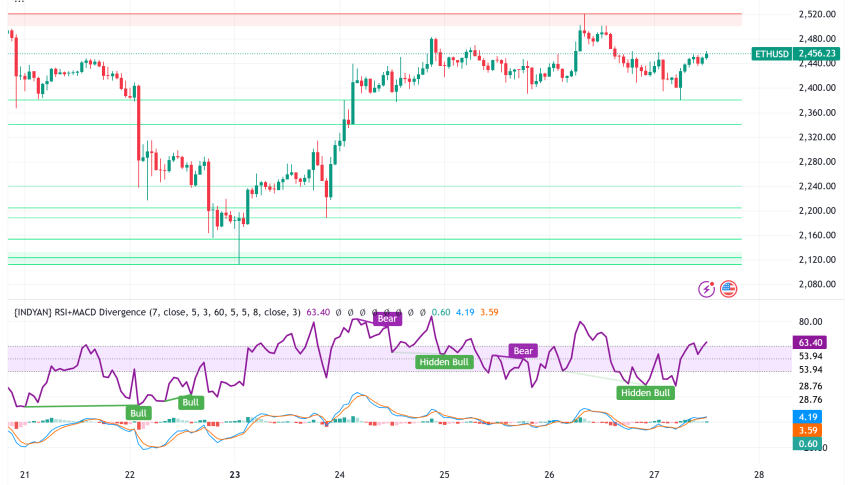

The ETH/USD pair trades at 2,457 level, facing immediate resistance at 2,470. Bullish crossover of 2,470 level can extend buying trend until 2,548 and 2,667 level. On the 4 hour timeframe, the pair has formed an upward trendline that’s supporting the bullish trend in Ethereum. Furthermore, the series of EMA are supporting buying trends in the pair. The MACD and RSI are holding in a buy zone; therefore, the 2,329 level will be a significant level to watch today. Below this level, Ethereum can take a dip until 2,174 and 2,090 levels. While buying can be seen over 2,370 level today. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.