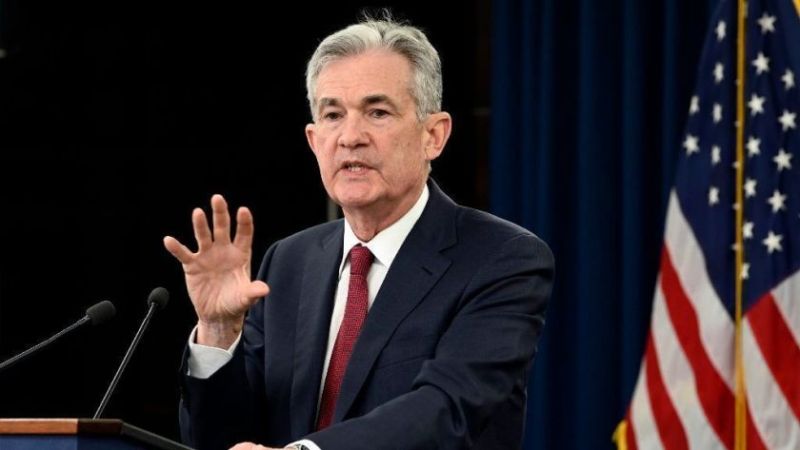

April Fed Announcements: Recap & Highlights

For now, it looks like today’s Fed Announcements have slightly weakened sentiment toward the dollar.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

The April meeting of the FOMC is now in the books and not much has changed. COVID-19 economic concerns persist and dovish policy continues to be the course of action. Following this afternoon’s Fed Announcements, the American indices are experiencing modest participation. With only a few hours left in the Wall Street session, the DJIA DOW (-148), S&P 500 SPX (+1), NASDAQ (-12) are trading mixed.

On the forex front, April has been a challenging month for the Greenback. Today has been no different as performance is mixed. Gains for the U.S. dollar have been posted by the EUR/USD (-0.03%) and USD/JPY (+0.21%). On the other hand, the USD/CAD (-0.44%) is trending south. For now, it looks like today’s Fed Announcements have slightly weakened sentiment toward the dollar.

April Fed Announcements: Updates & Highlights

Across the financial world, not much was expected from today’s Fed Announcements. Here are a few of the key quotes and statements from the third prepared release of 2021:

- The Federal Funds Rate has been held static at 0.0-0.25%.

- “Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened.”

- “The sectors most affected by this pandemic remain weak but have strengthened.”

- “Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative.”

- “The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month; at least $40 billion per month in mortgage-backed securities.”

Bottom Line: Today’s Fed Announcements have come and gone as expected. QE unlimited is to remain in place for the foreseeable future ― zero rates and massive bond buys appear to be new norms. At least for 2021, it looks like the Fed is going to hold its exceedingly dovish pandemic stance.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account