Fundamentals and Technicals Align for A Bearish Reversal in Gold

Gold Technical Analysis Points Down

Gold turned bearish in summer last year, as it started losing its safe haven status, which was transferred to cryptocurrencies. That’s one of the reasons why digital currencies have been surging higher. Gold was finding support at moving averages as it was slipping lower, particularly the 50 SMA (yellow) on the weekly chart, but it eventually broke below it and fell around $400.

The price slipped to $1,675, but the 100 SMA (green) turned into support on the same time-frame chart. Sellers retested that moving average by the end of March, as the USD was making a comeback that month, but they failed again and the price started bouncing higher, after forming a pin candlestick above the 100 SMA, which is a bullish reversing signal after the decline.

GOLD climbed more than $100, approaching the 20 SMA (gray) during this month, as the USD turned bearish again. But now it seems like the climb might be over, with the retrace higher coming to an end, as the stochastic indicator which is almost overbought shows. The 20 SMA is providing resistance on top, while the last two candlesticks look as dojis, which are bearish reversing signals now, after the retrace higher.

Besides the technical picture which is pointing to a bearish reversal, fundamentals also point down for Gold. The USD has declined unreasonably fast this month, but it gave a strong sign of turning bullish in the last trading day on Friday, after it made a big reversal higher, climbing more than 100 pips against all major currencies. EUR/USD lost nearly 150 pips.

US Fundamentals Point to A Stronger USD

The FED brushed aside the fast economic expansion, pledging to keep the stimulus programmes going, but they will be forced to except the picture, which is quite bright across all front and will keep getting better in Q2 and Q3, as we head towards summer and further normalizing. The economic data released on Friday alone paints the picture quite clearly.

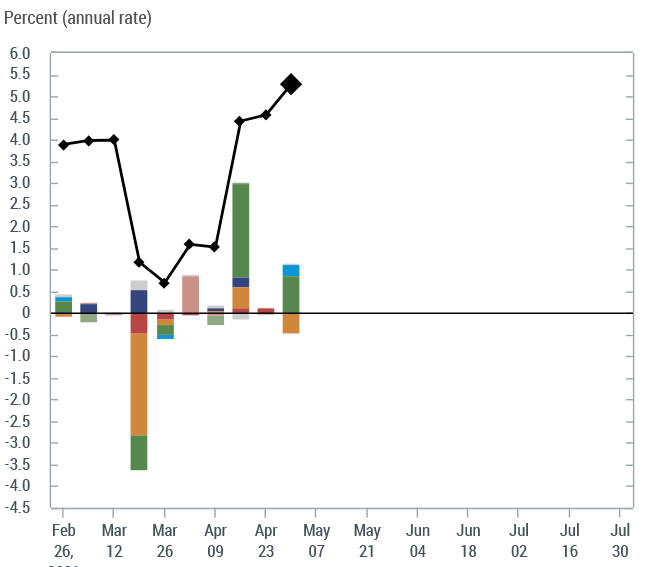

NY Fed GDPNowcast for Q2 climbs to 5.28% from 4.57%

Strong consumption drives the increase

Consumer sentiment data from the University of Michigan

- Uni of Michigan final April consumer sentiment 88.3 points vs 87.5 expected

- Prelim consumer sentiment was 86.5

- Current conditions 97.2 points vs 97.6 expected

- Prelim current conditions 97.2 points prior

- Expectations 82.7 points vs 81.0 expected

- Prelim expectations 79.7 points

- 1-year inflation 3.4% vs 3.7% prelim

- 5-10 year inflation 2.7% vs 2.7% prelim

The consumer sentiment report from the University of Michigan for April improved after the first reading earlier this month and it has been improving for several months. This shows that the US consumer will increase spending further.

US Personal Consumption Expenditure Report for March 2021:

- March core PCE YoY +1.8% vs +1.8% expected

- February was YoY +1.4%

- PCE core MoM +0.4% vs +0.3% expected

- Prior MoM +0.1%

- Deflator YoY +2.3% vs +2.3% expected

- Prior deflator YoY +0.5%

- Deflator MoM +0.5% vs +0.5% expected

- Prior MoM deflator +0.2%

Consumers spending and income for March:

- Personal income +21.1% vs +20.3% expected. Prior month -7.1%

- Personal spending +4.2% vs +4.1% expected. Prior month -1.0%

- Real personal spending +3.6% vs +3.7% expected. Prior month -1.2%

The consumer expenditure and personal spending confirm the improved consumer sentiment of the last several months. Personal spending and personal income made a reversal and a big jump as well.