GBP/USD Ends Up Higher After the BOE Decision

[[GBP/USD-sponsored]]

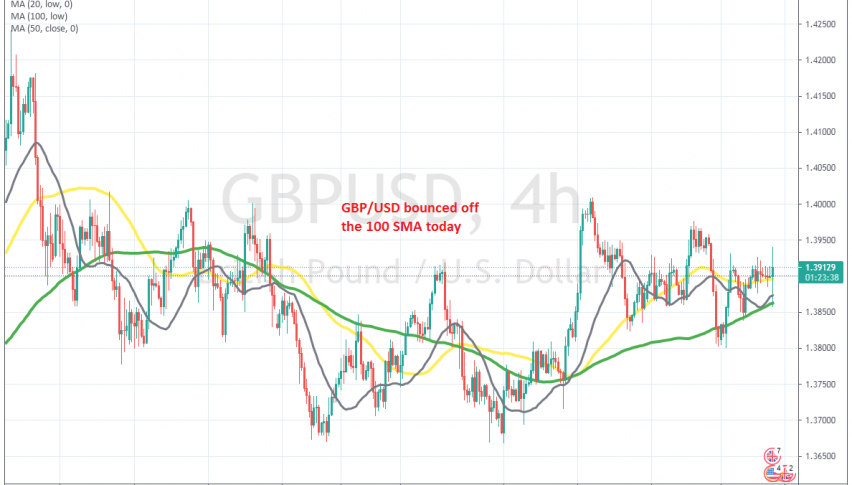

GBP/USD used to be one of the most bullish pairs since March last year until late February this yer, climbing around 28 cents from the bottom. Although since February this pair has been trading mostly sideways, as the USD has been gaining some strength.

Today we saw some whipsaw price action during the Bank of England meeting, but GBP/USD eventually ended up higher after the meeting, after the BOE hinted at slowing the QE stimulus purchases, which would be positive for the GBP in the medium term.

BOE Monetary Policy Decision – 6 May 2021

- BOE leaves bank rate unchanged at 0.10%, as expected

- Prior meeting rates were 0.10%

- Bank rate votes 0-0-9 vs 0-0-9 expected

- Gilts purchases £875 billion

- Corporate bond purchases £20 billion

- Total asset program £895 billion (unchanged)

- UK GDP expected to have fallen by ~1.5% in Q1, less weak than previously assumed

- GDP is expected to recover strongly to pre-COVID levels over the course of this year

- After 2021, the pace of GDP growth is expected to slow as transitory factors wane

- Inflation is projected to rise to close to the target in the near-term

- In the central projection, CPI inflation rises temporarily above the 2% target towards the end of 2021, owing mainly to developments in energy prices

- These transitory developments should have few direct implications for inflation over the medium-term

- Does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably

- Full statement

Monetary Policy Report

- Forecasts UK GDP growth at 7.25% in 2021, 5.75% in 2022

- Forecasts UK CPI at 2.31% in one year’s time; previously 2.07%

- Monetary policy report

The existing programme of £150 billion of UK government bond purchases had started in January and its completion was expected by around the end of 2021. As envisaged since the announcement of the programme in November 2020 and consistent with developments in financial markets since then, the pace of these continuing purchases could now be slowed somewhat. The expected completion point of the purchase programme remained unchanged. This operational decision should not be interpreted as a change in the stance of monetary policy. As measured by the target stock of purchased assets, that stance remained unchanged. Further details of the planned operational approach to gilt purchases between the May and August MPC meetings were set out in the Market Notice accompanying these minutes. Should market functioning worsen materially, the Bank of England stood ready to increase the pace of purchases to ensure the effective transmission of monetary policy.