FED Starting to Accept Inflationary Pressures, As Prices Seem to Be Going Up

Inflation keeps increasing in the US, forcing the FED to starting accept the reality

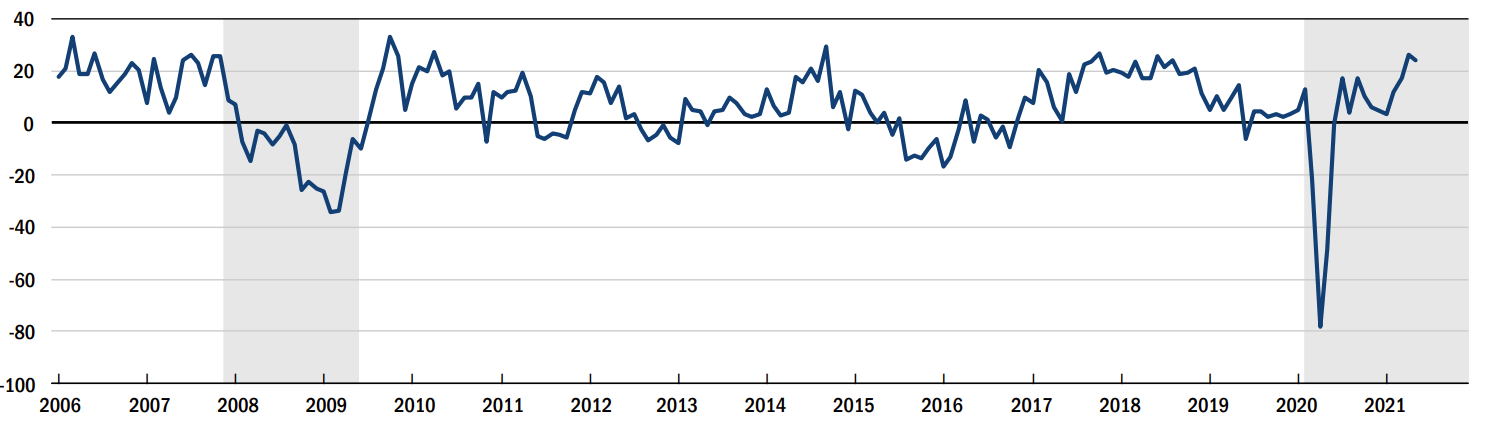

The USD has been declining for about a year, apart from the Q1 of this year, when it attempted to make a reversal. Although, it didn’t last long and the Buck resumed the bearish trend again in April. The main reason for this bearish momentum has been the excessive amount of cash thrown into markets from the US government and the FED, to fight the coronavirus effects.

Although, such amounts of USD have weakened the Buck as well as increasing inflation. Although, the FED has been trying to play inflation down, considering it as transitionary. But, prices keep increasing, so it doesn’t look too transitionary.

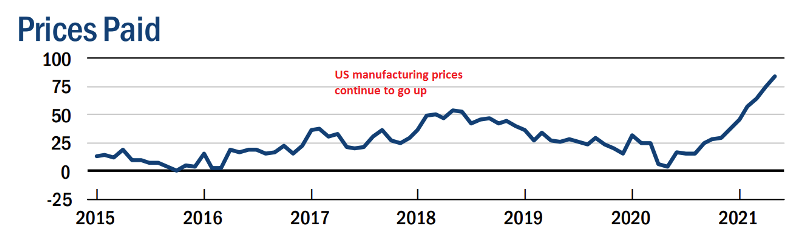

This will mean that the FED will start accepting the reality and the USD will start to turn bullish. The New York manufacturing survey shows a jump in prices, while FED’s Bostic also made some hawkish comments on inflation, so the FED is already shifting on inflation now.

New York-area manufacturing survey data

- May US Empire Fed manufacturing index 24.3 vs 24.0 expected

- Prior was 26.3

- New orders +28.9 vs +26.9 prior

- Prices paid +83.5 vs +74.7 prior (record high since survey began in 2000)

- Prices received +37.1 vs +34.9 (record high since survey began in 2000)

- Six month conditions +36.6 vs +39.8 prior

- Employment +13.6 vs +13.9 prior

- Full report

FED’s Bostic on CNBC

- Pent-up demand will put pressure on prices, that is known

- We will be looking at how rapidly the economy recovers

- A healthy level of inflation is a sign that the economy is healthy and is growing

- I’m not worried about housing much right now

- The number of homes available right now is far below what’s normal

- I’m hopeful we’ll have a ‘more rational’ housing market in the coming months

- I’m going to keep my eyes open on inflation but now is not the time to worry about moving

We’ve heard plenty from Bostic in the past week. There’s nothing new here but the strong, definitive tone about pinning rates is slowly evaporating from all Fed members.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account