Gold Gains as Dollar Weakens – Inflation, Geopolitical Concerns Support

Gold prices are ticking higher as the US dollar trades close to multi-month lows in anticipation of the upcoming Fed meeting minutes

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

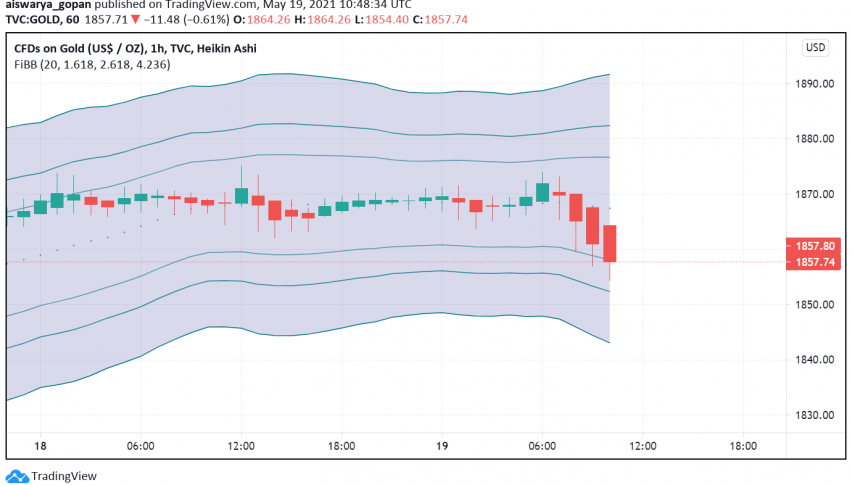

Early on Wednesday, gold prices are ticking higher as the US dollar trades close to multi-month lows in anticipation of the upcoming Fed meeting minutes releasing later in the day, with markets worried about the central bank extending its dovish outlook. At the time of writing, GOLD is trading at a little above $1,857.

The safe haven appeal of gold has been triggered as inflation worries persist in global financial markets despite Fed officials repeatedly playing down any effect as temporary. Last week, the US CPI posted a stronger than forecast increase, but policymakers remain unconvinced that it would drive a sooner than expected rate hike from them.

This raised concerns of the Fed holding steady with its monetary easing plans for a longer period of time, even as the US economy and other economies around the world start emerging out from the coronavirus induced downturns. This has driven significant gains in the precious metal as dovish central banks support the appeal of bullion as an investment and also serve to weaken investor confidence in the dollar, which shares a negative correlation with the commodity.

Gold prices are also enjoying support from ongoing geopolitical tensions in the Middle East where Palestinian rebels resorted to launching rockets in retaliation to Israeli airstrikes in Gaza. Even though world powers have called for a ceasefire, concerns are on the rise that the conflict could potentially escalate further, lending additional support to the safe haven metal.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account