US Dollar Rises Above 90 Level Against Key Rivals – Fed Minutes’ Impact

The US dollar appears to have regained some of its strength following the release of the latest Fed meeting's minutes in the previous

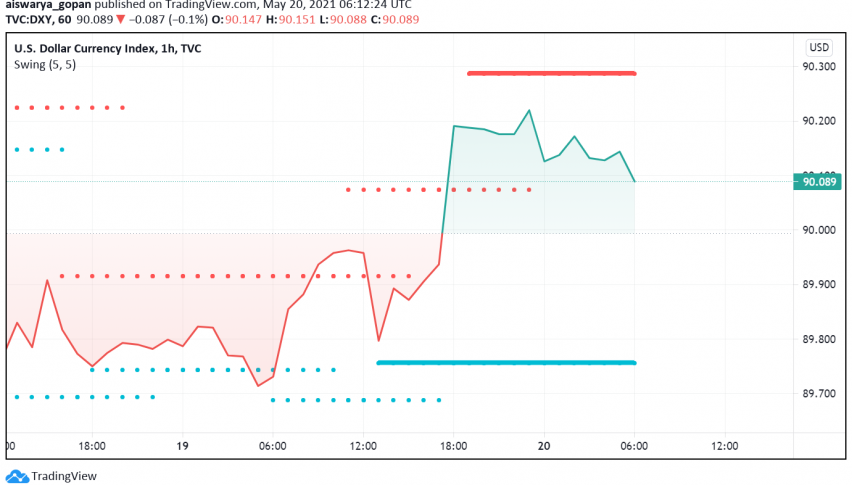

Early on Thursday, the US dollar appears to have regained some of its strength following the release of the latest Fed meeting’s minutes in the previous session which showed greater interest in tapering off bond purchases among policymakers. At the time of writing, the US dollar index DXY is trading around 90.08.

During the latest meeting held last month, many policymakers indicated interest in discussing the possibility of easing off on the Fed’s bond purchase program as economic recovery gathers strength. Markets took this as an encouraging sign after Fed Chair Powell has repeatedly insisted on staying on course with monetary easing measures until full recovery in inflation and employment till pre-pandemic levels.

The latest comments published in the minutes will increase expectations among investors for possible implementation of these measures in case upcoming economic data out of the US comes in stronger than forecast. The next non-farm payrolls scheduled for release on June 3 especially will be closely monitored, raising hopes for the Fed to consider tapering in their next meeting scheduled in June.

The rebound in the US dollar has weakened other leading currencies, in particular the Euro which has weakened from its three-month high. The dollar index has also risen past the key 90 level after having fallen to the lowest levels seen in three months, supported also by an uptick in US Treasury yields.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account