EUR/GBP Reverses Down, After Lagarde Pledges to Keep the Money Flowing

EUR/GBP resumes the downtrend, as the ECB keeps the policy accommodative

EUR/GBP has been on a bearish trend since early this year, after the EU-UK trade deal was reached, validating the Brexit deal. This pair lost more than 7 cents until the first week of April, when we saw a retrace higher, taking the price above 0.87.

But, the retrace ended earlier this month and the downtrend resumed again. We have had quite a few sell forex signals in this pair during the decline and opened another one late last week as the price retraced higher again, finding resistance at the 200 SMA (purple) and the 100 SMA (green).

Last night though we saw a reversal down after these moving averages ejected the price and today EUR/GBP is continuing lower, as the ECB president Christine Lagarde is commenting that the ECB will keep the policy loose, given the uncertainty, which I think will continue again. So, we are holding on to our signal, which is in profit now. Services also jumped higher in April, leaving behind recession now.

Remarks by ECB president, Christine Lagarde

- Given uncertainty, accommodative policies remain necessary for months to come

- Believes that we are in a recovery process

- But the recovery is still uncertain

- Euro area will go back to pre-virus levels in 2022

- Inflation rise this year is temporary

- ECB should see through temporarily higher inflation

EUR/GBP Live Chart

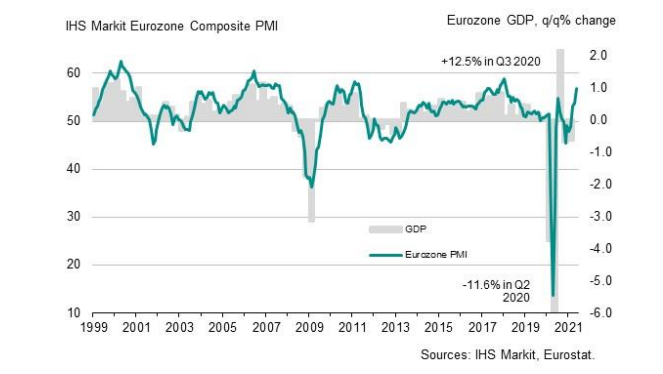

Latest data released by Markit – 21 May 2021

- May flash services PMI 55.1 points vs 52.5 expected

- April services were 50.5 points

- Manufacturing PMI 62.8 points vs 62.5 expected

- April manufacturing was 62.9 points

- Composite PMI 56.9 points vs 55.1 expected

- Prior composite PMI was 53. 8 points

This is an encouraging report as it reaffirms some pickup in services activity in the euro area as economies start to get back on their feet and move on from virus restrictions. The manufacturing sector is stalling a little but is keeping at robust levels overall.

“Demand for goods and services is surging at the sharpest rate for 15 years across the eurozone as the region continues to reopen from covid-related restrictions. Virus containment measures have been eased in May to the lowest since last October, facilitating an especially marked improvement in service sector business activity, which has been accompanied by yet another near-record expansion of manufacturing.

“Growth would have been even stronger had it not been for record supply chain delays and difficulties restarting businesses quickly enough to meet demand, especially in terms of re-hiring. The shortfall of business output relative to demand is running at the highest in the survey’s 23-year history.

“This imbalance of supply and demand has put further upward pressure on prices. How long these inflationary pressures persist will depend on how quickly supply comes back into line with demand, but for now the imbalance is deteriorating, resulting in the highest-ever price pressures for goods recorded by the survey and rising prices for services.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account