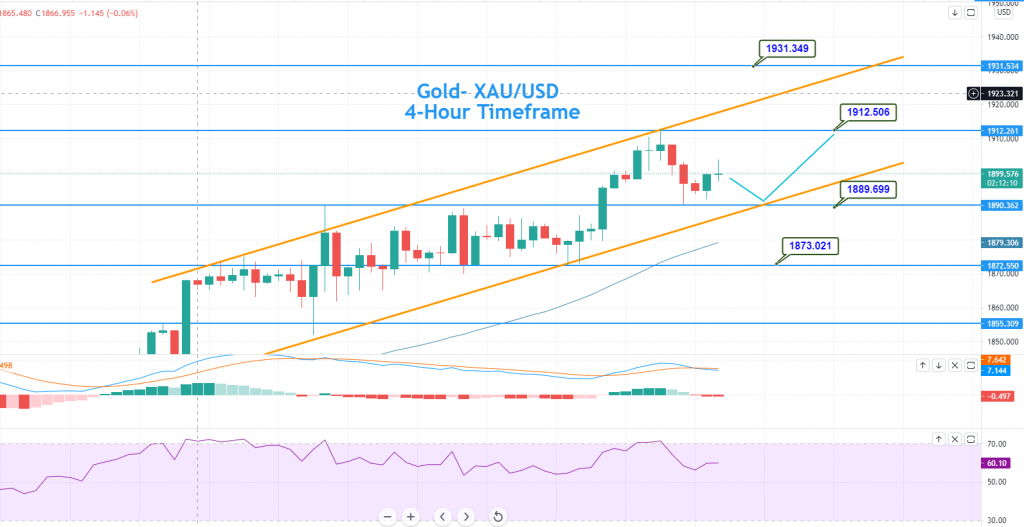

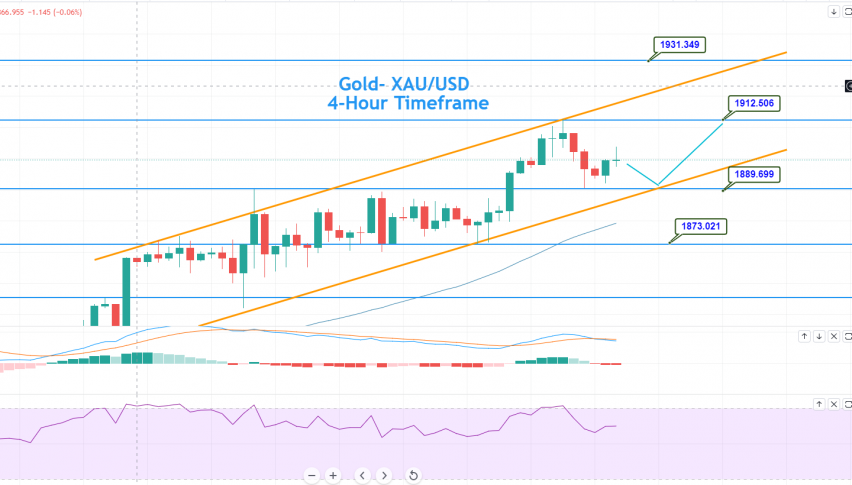

Gold Price Forecast – Upward Channel In Play, Bullish Bias Dominates

During Wednesday's Asian trading session, the yellow metal gold succeeded to extend its previous long winning streak and is still taking

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

During Wednesday’s Asian trading session, the yellow metal gold succeeded to extend its previous long winning streak and is still taking bids around $1,900 level as the latest hike in the COVID-19 infections leads the Australian government to announce a new seven day lockdown in the second biggest state Victoria, which in turn, weighs on the market trading sentiment and contributes to the safe-haven gains. It is worth mentioning that the bullion price is currently trading at $1896, marginally lower as compared to the previous day as it reached fresh four month highs at $1913 a day before.

However, the ongoing buying bias surrounding the GOLD prices was mainly sponsored by the rising coronavirus cases and slower vaccination drives. This raises the possibility of extended lockdowns, which directly exerts a negative impact on the market sentiment. Furthermore, the long bullish rally in the gold prices was further bolstered by the long-lasting geopolitical tensions and previously released downbeat Chinese economic data. In contrast to this, the latest positive developments on the US-China trade front keep challenging the market’s risk-off mood, and is one of the key factors that kept the lid on any additional gain. Meanwhile, the broad-based US dollar strength, backed by multiple factors, was also seen as another factor that cap further upside momentum as the dollar normally moves inversely to the yellow metal. Investors seem cautious to place any big position ahead of the critical US economic data. As of writing, the yellow metal price is trading at 1,898.50 and consolidating in the range between 1,892.22 and 1,899.67.

Despite the positive developments on the US-China trade talks, the S&P 500 futures failed to extend their previous-day bullish performance and dropped 0.22% to 4,185 on the day. Meanwhile, the cautious mood ahead of the Fed’s future action also keeps the market trading tone under pressure. Hence, the bearish bias around the market trading sentiment was seen as one of the key factors underpinning the safe-haven gold prices.At the USD front, the broad-based US dollar stopped its previous-day bearish run-up and recovered from early January lows. However, the buck has got a lift from emerging views. The Federal Reserve is slowly but surely edging towards a discussion about tightening monetary policy. Meanwhile, the downbeat market trading sentiment has also played its major role in underpinning the safe-haven US dollar. Traders seem cautious to place any strong position ahead of the US Gross Domestic Product (GDP) data, Durable Goods Orders, Corporate Profits, Initial Jobless Claims, and Pending home sales data, which are due to release later in the week.

In contrast, the recently released positive Australian economic data and ongoing COVID-19 vaccination progress keep helping the market trading sentiment limit deeper losses, which was seen as one of the critical factors that could cap upside momentum in the yellow metal prices. Australia’s Private Capital Expenditure for the Q1 climbed over the 2.0% market forecast and 3.0% previous readings with a 6.3% jump at the data front. Apart from this, the latest positive developments on the US-China trade talks keep challenging the market’s risk-off mood, which was seen as another factor that cap yellow-metal gains. As per the latest report, China’s Vice Premier Liu He and US Trade Representative Katherine Tai said they had fair and constructive talks. Meanwhile, China’s Commerce Ministry said both sides agreed that Sino-American mutual trade is significant, which is why communications will continue.

Looking forward, the market traders will keep their eyes on the release of the US Gross Domestic Product (GDP) data, Durable Goods Orders, Corporate Profits, Initial Jobless Claims, and Pending home sales data. Apart from these, the risk catalyst like geopolitics and the virus woes will not lose their importance.

Gold – XAU/USD – Daily Support and Resistance

S3 1836.78

S2 1863.85

S1 1881.49

Pivot Point 1890.92

R1 1908.56

R2 1917.99

R3 1945.06

GOLD is trading strongly bullish around 1,907 level, having violated the strong resistance area of 1,890 level. On the upper side, the violation of the 1,907 level can extend further buying trend until the 1,920 level. The MACD and RSI support a strong buying trend, and thus, the breakout is expected ahead. Gold may find immediate support around 1,890 levels. Consider trading bullish over 1,907 level today and bearish below the same. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account