US Dollar Enjoys Support From Strong Core PCE Figures

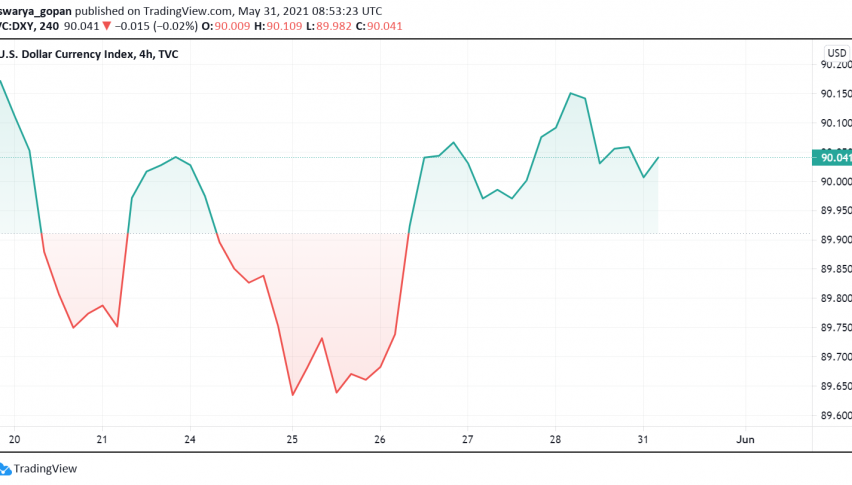

The US dollar is starting the fresh trading week on an optimistic note, holding close to the highest level seen since two month against

The US dollar is starting the fresh trading week on an optimistic note, holding close to the highest level seen since two month against safe haven Japanese yen, after core PCE figures came in stronger than forecast and raised hopes for the Fed to consider tapering stimulus measures. At the time of writing, the US dollar index DXY is trading around 90.04.

Data released last Friday revealed that consumer prices across the US rose to the highest reading seen in almost three decades, supported by rapid economic recovery and disruptions in global supply chains hampering access to raw materials. the core PCE price index, which is a closely watched gauge of inflation monitored by the Fed, increased by 3.1% YoY for the month of April, against expectations for a 2.9% rise instead.

However, economists believe that the surge could also be due to last year’s weak reading when the US first went into lockdown mode, expecting this figure to ease in the coming months. Despite this, the reading has once again spurred investors to hope for the Fed to step in with tightening measures sooner than anticipated, especially if this keeps inflation above its 2% target for an extended period of time as the US economy recovers from the coronavirus crisis.

Although the benchmark 10-year US Treasury yields have eased slightly lower, the US dollar is enjoying support from possible change in sentiment among Fed officials towards beginning discussions about tapering asset purchases. With the high core PCE reading, the focus now turns to the upcoming release of the non-farm payrolls data at the end of the week to assess the pace of economic recovery and if it will bolster the central bank’s policymakers to consider turning hawkish sooner than initially planned.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account