GBP/USD Bounces Off the 100 SMA, As UK Services Jump After Reopening

UK servies jump to a decades high in May, sending GBP/USD higher

[[GBP/USD-sponsored]]

GBP/USD has been bullish since March last year, as the USD keeps declining while the GBP increased due to the EU-UK trade deal which was reached last December, which improved the sentiment. In Q1 we saw a retreat in this pair as USD buyers started to fight back, but the bullish trend resumed again in Q2 and this pair broke above the February’s highs.

GBP/USD Live Chart

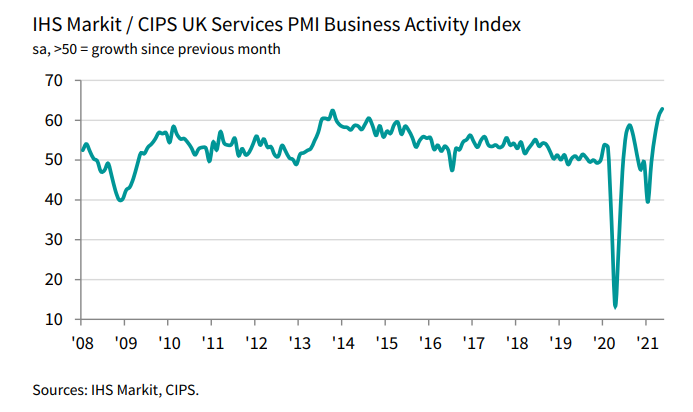

Now with the reopening of the country, the UK economy is expanding fast, joining the rest of the world. Services were in recession until March, but they came out of recession in April and in May they jumped to the highest level in decades. GBP/USD bounced off the 100 SMA (green) on the H4 chart, so the bullish trend is back on. We booked profit on EUR/GBP after this jump in GBP/USD, since it sent that pair down.

UK May Final Services PMI

- May final services PMI 62.9 vs 61.8 prelim

- Composite PMI 62.9 vs 62.0 prelim

“UK service providers reported the strongest rise in activity for nearly a quarter-century during May as the roll back of pandemic restrictions unleashed pent up business and consumer spending. The latest survey results set the scene for an eye-popping rate of UK GDP growth in the second quarter of 2021, led by the reopening of customer-facing parts of the economy after winter lockdowns.

“Pressure on business capacity due to a spike in demand and staff hiring difficulties emerged as a major challenge for service sector companies in May. Job creation was the strongest for over six years, but backlogs of work accumulated to the greatest extent since the summer of 2014.

“The successful vaccine roll out has generated a strong willingness to spend and fortified business optimism across the service economy. However, inflationary trends intensified in May as suppliers passed on higher transport bills, staff costs and raw material prices. Imbalanced demand and supply appears to have spread beyond the manufacturing sector, which contributed to the steepest rise in prices charged by service providers since the survey began in July 1996.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account