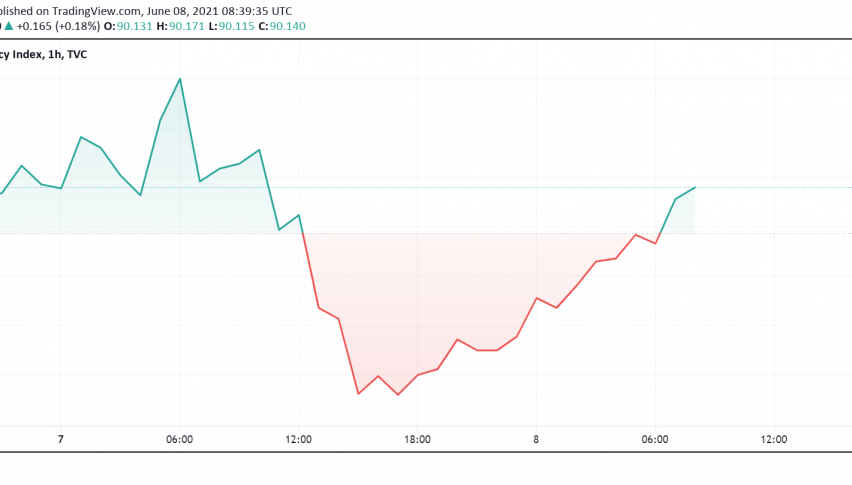

US Dollar Still Weak, Market Look to CPI For Direction

The US dollar continues to trade under pressure into Tuesday with the focus remaining on the weak NFP report even as markets await release

The US dollar continues to trade under pressure into Tuesday with the focus remaining on the weak NFP report even as markets await the release of the CPI report due later in the week before deciding their next moves. At the time of writing, the US dollar index DXY is trading around 90.11.

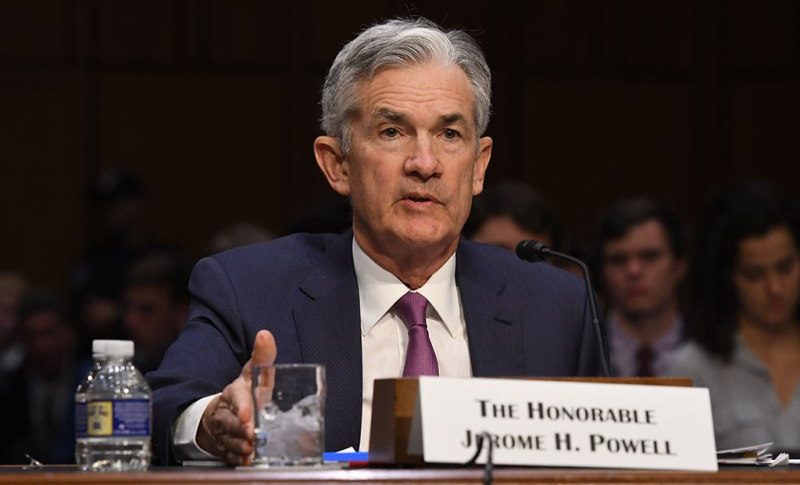

The disappointing employment report tempered investors’ expectations of the Fed considering a tapering of its monetary stimulus efforts anytime soon. Recent positive economic data releases had buoyed optimism of this happening even though Fed officials had repeatedly insisted that they would only consider reversing their dovish stance once employment and inflation rebound completely.

The weakness in the dollar has helped boost the Euro, sending it back up from the lowest level seen in three weeks. The safe haven currency Japanese yen has also recovered after dipping to a two-month low against the reserve currency last week.

In the wake of the weak NFP report, markets have now adjusted their timeline to anticipate the Fed to announce tapering of its bond purchase programs towards the end of this year while the process would begin only by early 2022. Despite the US economy posting strong recovery in some areas, the labor market remains under strain while the outlook for inflation remains uncertain in the near-term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account