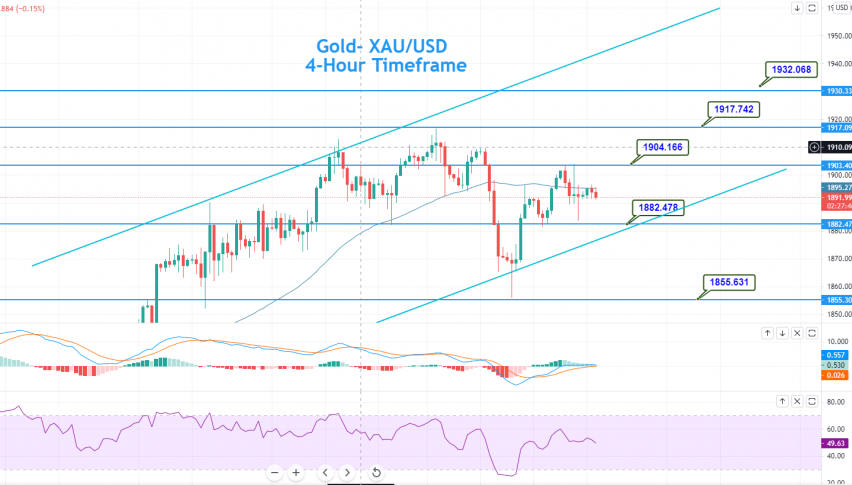

Gold Price Forecast – 50 EMA Crossover; Can we Expect a Sell Trade?

During Wednesday's Asian trading session, the safe haven metal gold succeeded to stop its previous day's declining streak and drew some

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

During Wednesday’s Asian trading session, the safe haven metal, gold, managed to stop its decline of the previous day, drawing some modest bids around the $1,900 level, as the latest hike in the number of infections with the COVID-19 Delta variant in the UK has prompted the British government to delay the ending of lockdown measures, which in turn is weighing on the market trading sentiment.

The prevalent buying bias in GOLD was mainly sponsored by the growing incidence of coronavirus cases and slower vaccination drives. As a result, the lockdown in the UK has been extended, and this had an instant bearish impact on the market mood. Moreover, the new bullish rally in gold was further bolstered by the ever-increasing geopolitical tensions and the less positive Chinese economic data that was released recently. Meanwhile, the uncertainty over US President Joe Biden’s infrastructure spending remains on the cards, amid anxiety over the Fed’s next moves. All of this favors the safe-haven assets.

The latest optimism over global economic recovery keeps challenging the risk-off mood on the market. This was seen as one of the key factors that limited any additional gains in gold. Meanwhile, the bullish bias towards the broad-based US dollar, which was backed by multiple factors, was also seen as another factor that capped any further upside momentum in the bullion prices, as typically, the dollar moves inversely to gold. Investors seem cautious about placing any prominent positions ahead of the upcoming US inflation data. At the time of writing, the yellow metal was trading at 1,893.68, and consolidating in the range between 1,891.51 and 1,896.37. Despite the positive developments over the global economic recovery, the S&P 500 futures failed to extend its recent bullish performance, turning sour on the day, as the renewed rise in COVID-19 infections has resulted in an extension of lockdown measures in the UK.

Meanwhile, the cautious mood ahead of the Fed’s next move is also putting pressure on the market trading tone. In addition to this, the declines in the S&P 500 futures were further bolstered after China released downbeat inflation data early on Wednesday. China’s headline Consumer Price Index (CPI) eased below the 1.6% YoY forecast, to 1.3%, but the Producer Price Index (PPI) jumped to its highest level since 2008, marking a 9.0% rally versus the expectations of 8.5%. Therefore, the bearish bias surrounding the market trading sentiment was seen as one of the key factors underpinning the safe-haven gold prices.

On the USD front, the broad-based US dollar succeeded in extending its recent bullish run-up, remaining well bid on the day. However, the buck was boosted by the downbeat market trading sentiment, which plays a key role in underpinning the safe-haven assets. Traders seem cautious about placing any strong positions ahead of the US inflation data that is due for release soon; therefore, the upticks in the US dollar have become one of the key factors that have kept a lid on any additional gains in the precious metal.

Looking forward, the market traders will be looking out for the release of the US inflation data. Apart from this, investors are also waiting for the European Central Bank (ECB) policy decision, in order to better assess the possibilities regarding economic recovery from the COVID-19 pandemic. In addition to this, other risk catalysts, like geopolitics and the virus woes, will exert a major influence on the financial markets.

Gold – XAU/USD – Daily Support and Resistance

S3 1,853.65

S2 1,873.56

S1 1,883.19

Pivot Point 1,893.47

R1 1,903.1

R2 1,913.38

R3 1,933.29

The precious metal is trading at the 1,891 level and facing strong resistance at the 1,904 level. Closing of gold prices above the 1,882 level supports a robust bullish bias. On the lower side, a bearish breakout at 1,882 could lead the gold prices towards 1,872 and 1,860 today. On the higher side, GOLD could find resistance at the 1,904 level, where a bullish breakout would open up additional room for buying until the 1,917 level today. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account