Shorting EUR/GBP, as UK Earnings Jump to 20 Year Highs

EUR/GBP has failed at the 200 SMA once again and is reversing down now

The EUR/GBP was really bearish during Q1 of this year, but for about a month, this forex pair has been trading sideways, with the 200 SMA (purple) acting as resistance on the H4 chart. In fact, the highs have been getting lower, which indicates that sellers are starting to regain control, hence most of our signals in this pair being sell trades.

A while ago, we saw another great selling opportunity, as the EUR/GBP climbed to the top of the range, while the 200 SMA was acting as resistance once again. We decided to open a sell forex signal below that moving average, and now the price has reversed back down after the UK earnings report showed another jump in April, taking it to a 20 year high. So, the price has reversed back down now and is heading for our take profit target.

Latest data released by ONS – June 15, 2021

- May jobless claims change -92.6k vs -15.1k prior

- April jobless claims was -15.1k

- Claimant count rate 6.2%

- April claimant count rate was 7.2%

- April ILO unemployment rate 4.7% vs 4.7% expected

- March unemployment rate was 4.8%

- April employment change 113k vs 135k 3m/3m expected

- March employment change was 84k

- April average weekly earnings +5.6% vs +4.9% 3m/y expected

- March earnings were +4.0%

- April average weekly earnings (ex bonus) +5.6% vs +5.3% 3m/y expected

- Prior earnings ex bonuses +4.6%

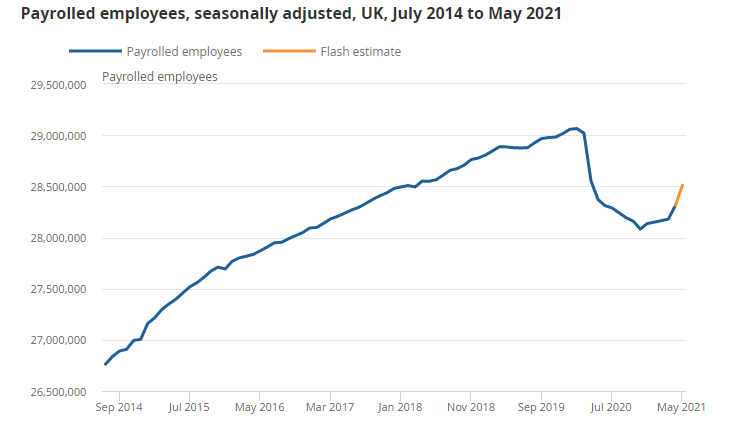

There was a slight delay in the release by the source. ONS notes that the number of payrolled employees has increased for a sixth straight month, and was up by another 197,000 in May, to 28.5 million in total. However, that is still 553,000 below pre-pandemic levels.

EUR/GBP Live Chart

Annual growth in average employee pay has continued to increase, however this is driven by compositional effects of a fall in the number and proportion of lower-paid employee jobs and because the latest month is now compared with April 2020, when earnings were first affected by the coronavirus (COVID-19) pandemic (the base effect).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account