GBP/USD Retesting the 20 SMA Again, as it Tries to Turn Bullish

GBP/USD attempting to turn bullish, after the comments from FED's Williams

The GBP/USD has been really bullish for more than a year, climbing more than 28 cents from the bottom. We saw a pullback in Q1, but the bullish trend resumed again, with this pair making new highs, unlike other USD pairs, which couldn’t.

But, the USD turned bullish last week, after the FED changed its rhetoric and mentioned rate hikes and tapering of the monthly bond purchases. So, this pair reversed, falling below 1.40, and losing nearly 600 pips from the top.

GBP/USD Live Chart

GBP/USD

This week, we are seeing an attempt by buyers to reverse the course, and after the first failure to break above the 20 SMA (gray), it seems like buyers are going to push the price above this moving average this time, in the second attempt.

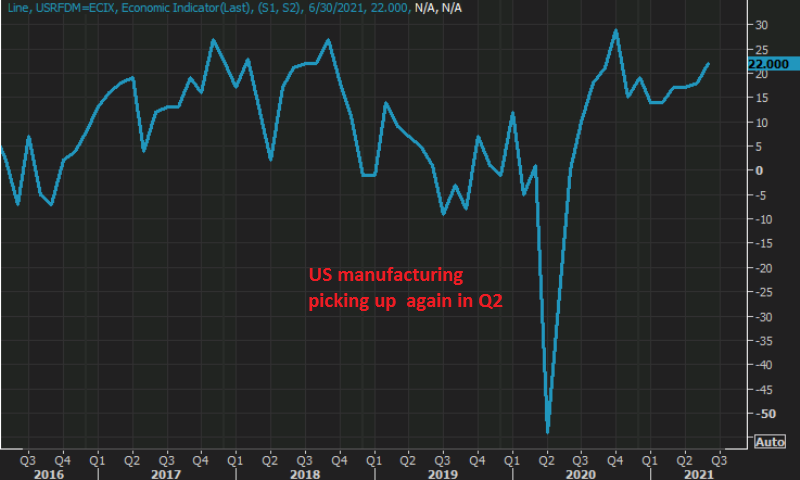

They have just pushed the GBP/USD above it, so we will see if they can keep it above this level and push even higher. The US economic data continues to show a decent level of expansion, especially in the manufacturing sector. But, the comment by Williams, suggesting that price increases are temporary, is hurting the USD at the moment.

June Richmond-area manufacturing survey

- June Richmond Fed 22 points vs 18 expected

- May was 18 points

- Shipments 8 points versus 12 in May

- New orders 35 points versus 18 in May

- Employees 19 points versus 25 in May

- Wages 37 points versus 31 in May

- Order backlog 22 points versus 36 in May

- Capacity utilization 5 points versus 10 in May

- Capital expenditures 12 points versus 16 in May

- Equipment and software 16 points versus 19 in May

- Prices paid 9.42% versus 9.82% annualized percent change

- Prices received 5.0% versus 5.41% last month

Six-month forward-looking indices:

- Shipments 50 versus 39 last month

- New orders 38 versus 38 last month

- Number of employees 51 versus 44 last month

- Wages 66 versus 64 last month

- Capacity utilization 35 verse 41 last month

- Capital expenditures 37 versus 42 last month

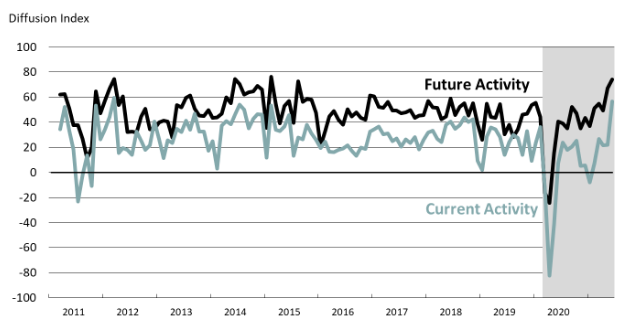

This is a positive report, but there’s plenty of nuance below the surface. Overall though, manufacturing looks to be a source of strength in the US economy through year end and beyond.

Philadelphia FED Non-Manufacturing Report

- Philly Fed June non-manufacturing activity 59.6 vs 36.9 prior

- Highest since March 2012

- New orders 27.4 vs 16.5 prior

- Full time employment 4.3 vs 24.0

- Firm level business activity 56.7 vs 22.1 prior

- Full report

US existing home sales data for May 2021:

- May existing home sales 5.80m vs 5.72m expected

- Prior was 5.85m

- Sales MoM -0.9% vs -2.7% prior

- Median price $350,300 vs $341,600 prior (+23.6% YoY)

- Inventory 1.23m (2.5 months) vs 1.16m, or 2.4 months prior

“Home sales fell moderately in May and are now approaching pre-pandemic activity,” said Lawrence Yun, NAR’s chief economist. “Lack of inventory continues to be the overwhelming factor holding back home sales, but falling affordability is simply squeezing some first-time buyers out of the market.

“The market outlook, however, is encouraging,” Yun continued. “Supply is expected to improve, which will give buyers more options and help tamp down record-high asking prices for existing homes.”

Williams on Bloomberg TV

- Feels very good about the progress being made on vaccines

- Looking at the full set of data and taking uncertainty into account

- Sees 3-3.5% GDP growth in 2022

- Sees inflation around 2% in 2022

- Sees a sharp rise in prices as “mostly temporary”

- Policy “will really be driven by the data”

- We still have a long way to go to get maximum employment

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account