USD/CAD Slides to the 50 Daily SMA, After US Services Cool Off From Record Highs

USD/CAD is facing the 50 daily SMA now, after failing at the 100 SMA above

The USD/CAD has been on a bearish trend for more than a year, falling more than 26 cents, to 1.20, by the end of May. Moving averages were doing a great job as resistance for this pair, pushing it down on the daily chart.

But, the decline stopped at 1.20, and we saw a bounce, especially after the FED shifted their rhetoric, mentioning rate hikes last week. This caused the USD to gain some momentum, and this pair pushed up, coming close to 1.25, where it met the 100 SMA (green). which provided resistance before, in October last year.

The USD/CAD fails at the 100 SMA, but let’s see if the 50 SMA will turn into support

The price reversed down, and today’s US services report, which is listed below is responsible for the drop, as we saw a slide in the USD after the report was released. The report is the second strongest on record, but it is down from the all-time highs in May, and it also came short of expectations. For now, the USD/CAD is trading at the 50 SMA (yellow) on the daily chart, so let’s see if this moving average turns into support.

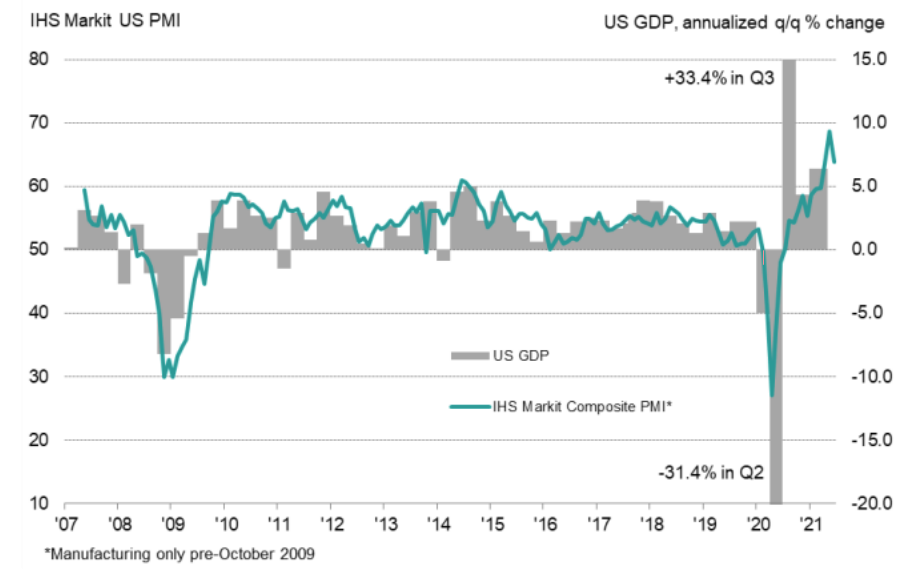

US services and manufacturing surveys from Markit for June 2021

- June prelim Markit services PMI 64.8 points vs 70.0 expected

- May services PMI was 70.4 points (record high)

- Manufacturing 62.6 points vs 61.5 expected (record high)

- May manufacturing was 62.1 points

- Composite PMI 63.9 points vs 68.7 prior

- Services input prices 74.6points vs 77.1 prior

- Manufacturing input prices 83.6 points vs 78.1 prior

- “Numerous panelists mentioned difficulties finding suitably trained candidates for current vacancies”

“The early PMI indicators point to further impressive growth of the US economy in June, rounding off an unprecedented growth spurt over the second quarter as a whole.“While both output growth and inflows of new orders have come off their peaks in both manufacturing and services, this is as much due to capacity constraints limiting firms’ abilities to cope with demand rather than any cooling of the economy.“Although price gauges have also slipped from May’s all-time highs, it’s clear that the economy continues to run very hot. Prices charged for goods and services are still rising very sharply, record supply shortages are getting worse rather than better, firms are fighting to fill vacancies and manufacturers’ warehouse stocks are being depleted at a worrying rate as firms struggle to meet demand.“While the second quarter is likely to represent a peaking in the pace of economic growth, a concomitant peaking of inflation is far less assured.”

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account