Can Chainlink (LINK) still recover with the infamous Death Cross looming?

It has not been a good month for Chainlink (LINK). It has been selling down sharply in the past eight weeks, and it looks like the bleeding has not stopped.

Chainlink Weekly Timeframe

When doing a technical analysis, it is best to begin with a longer timeframe and look at the bigger picture, to find out what the overall story is, before delving deeper into shorter timeframes. Here are the key observations based on Chainlink’s weekly timeframe:

-

- LINK is down almost 65% from all-time highs of 53.00

- Price has recently broken down below the 20.00 psychological support. This suggests that the bleeding may continue further.

- The next dynamic support is around the 12.00 zone, which is the 100-d moving average. There is a high probability that LINK could reach this level in the next weeks/months if the selling does not stop.

- A breakdown of the 12.00 support could mean it falling further, to between 7.50 and 9.00, which is the next major support level

Chainlink Daily Timeframe

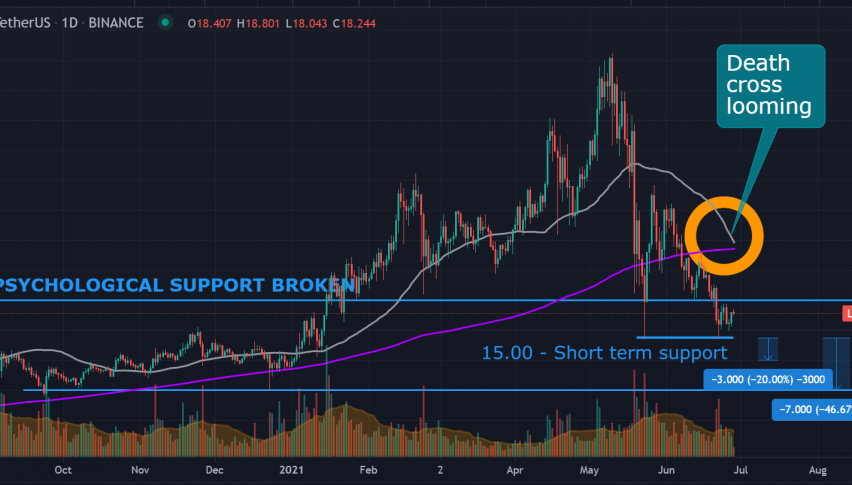

The shorter timeframe shows a “death cross” looming in the near future. Bitcoin (BTC), the leading cryptocurrency, just experienced a “death cross” a few days ago, and similar coins are following suit.

The term “death cross” is used by analysts to describe the cross down between a short-term moving average (usually 50 days) and a long-term moving average (usually 200 days). This signals a change in momentum, from predominant buying to selling, and it can imply that there is more pain coming.

The LINK chart above is not yet a “death cross”, but it shows the 50-day moving average (gray) about to cross below the 200-day moving average (purple).

Trade Idea: Momentum Short Sell

One possible way to capitalize on the downward price pressure currently being exhibited, in the following weeks, is to short sell LINK/USD.

If the selling momentum of LINK is indeed strong, it will break down the 16 to 15 levels. If this happens, enter a short position with a tight stop loss at 19.30. Target price levels at 12.00 and 8.00. This could result in a quick 20% to 40% gain. Risk only 0.25% to 0.75% of your portfolio for this trade.

-

- Short in 2 tranches: 16 (1st tranche), 15 (2 tranche)

- Stop loss: 19.30 – 19.50

- Target Price: 12.00 – 8.00 (very optimistic). Take half profits at 12, and sell all at 8

- Risk to Reward (RRR): 1.97 (if your average is at 15.50)

- Value at Risk (VAR): 0.25 – 0.75 only

Always remember to manage your risk when trading! Never let a small loss blow up your entire account.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account