Is the Bullish Trend Finally Over for the EUR/USD After the Softening Inflation?

EUR/USD is making a major bearish reversal, helped by fundamentals

Seems like the bullish trend in the EUR/USD finally seems to be over. This pair turned bullish in March last year, and remained so until January this year, when it peaked at 1.2360s. In Q1, we saw a pullback down, as the USD gained some momentum, but the decline resumed again in April, and the EUR/USD turned bullish once again.

The latest attempt to turn bullish ended at the 50 SMA for the EUR/USD

But buyers couldn’t make new highs, which was a sign that they were sort of exhausted, and earlier this month, we saw a bearish reversal after the FED made some hawkish comments regarding their monetary policy in the last meeting. This pair tumbled more than 4 cents, to 1.1850, by the middle of June, but retraced back up last week.

The 50 SMA (yellow), which has worked as support before now, turned into support again, which is another bearish sign. This pair failed at the 50 SMA last week and this week the bearish trend has resumed once again. Now the EUR/USD is headed for the support area around 1.1840, and if it breaks, it will open the door for 1.17 and lower.

EUR/USD Live Chart

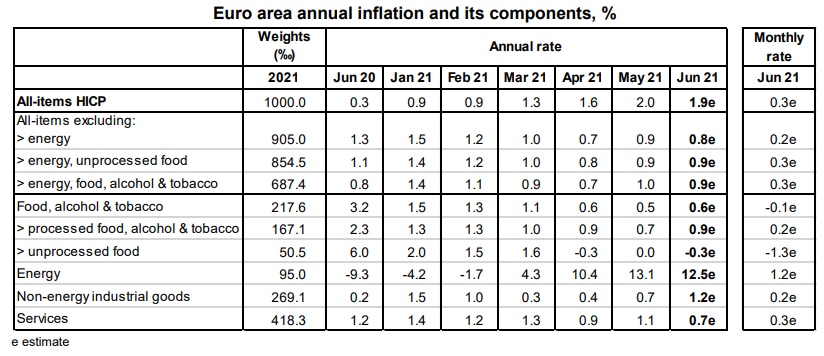

Latest data released by Eurostat – June 30, 2021

- June preliminary CPI YoY +1.9% vs +1.9% expected

- May CPI was 2.0%

- Core CPI YoY +0.9% vs +0.9% expected

- May core CPI was +1.0%

The readings are in line with estimates, and if core inflation remains just below 1%, it will give the ECB some leeway when it comes to sticking with the status quo going into September.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account