Bullish Sign in Oil, As It Remains Bullish Despite the OPEC+ Meeting

Crude Oil remains upbeat despite UAE trying to increase production in August

Crude Oil has been really bullish for more than a year, despite everything that has been happening during this time. The coronavirus and the lockdowns/restrictions have not bothered it, since the global economy is basically booming across many sectors, which is keeping the demand high for energy and the trend bullish for Oil.

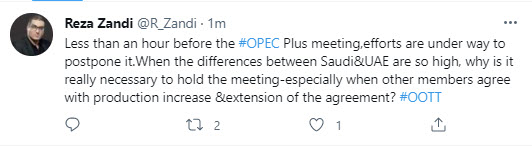

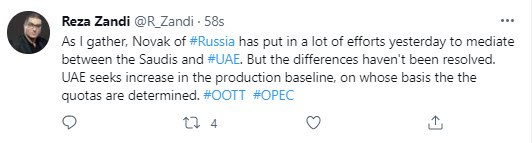

OPEC+ meeting which is supposed to be held today, is being delayed. OPEC Journalist Zandi commetted on the delay a while ago:

MAs are keeping crude Oil bullish

Nonetheless, crude Oil bulls aren’t too worried about the possible hike in production, which UAE is pushing for. yes, OPEC+ is blocking a deal/proposal for a 400k bpd increase in production output/month starting from August, but they aren’t doing so because they are against selling more Oil, instead it is more of a bargaining tool for them.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account