Choppy Session Continues for Gold – All Investors’ Eyes Watching For a Breakout!

During Monday's Asian trading session, the yellow metal price extended its early-day bullish run-up and drew some further bids

During Monday’s Asian trading session, the yellow metal price extended its early-day bullish run-up, drawing some further bids around the $1,790 level on the day, as various central banks, including those of Thailand, Ghana and Serbia, are increasing their GOLD holdings, due to signs of accelerating inflation. This turned out to be one of the key factors that underpinned the gold prices. Apart from this, the bullish bias affecting the gold prices also drew support from the ever-increasing coronavirus (COVID-19) fears, and doubts over the Fed’s next moves, which has put some downside pressure on the global equity market and contributed towards the gains in the safe-haven metal, gold.

Furthermore, the declines in the global equity market were further bolstered after China’s Caixin Services PMI dropped to the lowest level in 14 months during June. Across the ocean, Australia is still faced with the deadly Delta variant of the coronavirus, which has resulted in the government imposing local lockdowns that affect over 50% of the population.

In the meantime, Indonesia will be in a state of emergency from July 02 to July 20, while Malaysia and Thailand have also recorded the highest numbers of infections ever for the duration of the pandemic. This was seen as one of the key factors that provided some support to the precious metal, due to its safe-have status. In addition to this, the bullish bias surrounding gold could aso be attributed to the weaker US dollar, as a bearish USD tends to make it cheaper for holders of other currencies to purchase the yellow metal.

On the other hand, the optimism over the progress in terms of coronavirus vaccines and hopes of US President Joe Biden’s $1.7 trillion infrastructure spending plan kept challenging the risk-off mood on the market, which was seen as one of the key factors that kept a lid on any additional gains in the gold prices. At the time of writing, the yellow metal prices were trading at 1,787.08 and consolidating in the range between 1,784.56 and 1,789.97.

COVID Woes & Mixed US-China Economic Data

The market trading sentiment around the global markets failed to extend its positive performance of the previous week, and started to flash red on Monday, as the coronavirus (COVID-19) woes in the Asia-Pacific region and doubts over the Fed’s next moves kept the traders worried. Meanwhile, in June, China’s Caixin Services PMI dropped to its lowest level in 14 months, and this also played a significant role in undermining the market trading sentiment. Moreover, the declines in the global equity market were further bolstered after the US jobs report for June flashed mixed signals. On the data front, the headline Non-farm Payrolls (NFP) jumped past the 700K forecast and the prior figure of 583K, which was revised upwards. Meanwhile, the increase in the Unemployment Rate, from 5.8% to 5.9%, against the market expectations of 5.7%, coupled with no change in the Participation Rate of 61.6%, are still keeping the market sentiment under pressure.

Australia is still suffering from the effects of the Delta variant of the coronavirus, with local lockdowns limiting the activities of over 50% of the population. As per the latest report, a continual increase in the numbers of COVID infections has been recorded in Sydney, Queensland and New South Wales (NSW). Indonesia has also delared a state of emergency, which began on July 02 and is set to continue until July 20, while Malaysia and Thailand have also reported a resurge of the pandemic. Thus, the bearish appearance of the US stocks futures tends to highlight the risk-off sentiment, which in turn benefits the safe-haven metal, gold.

US Dollar and its Impact

Despite the downbeat market sentiment, the broad-based US dollar failed to gain any positive traction, remaining depressed on the day amid the previously released downbeat US data, which tends to undermine the greenback. Market traders now await further US economic data for additional clues on the central bank’s monetary policy. The weaker US dollar tends to benefit dollar-denominated commodities, including gold.

Given the lack of key data, the market traders will keep their eyes on the economic data from the United States and the next moves by the US Federal Reserve, for further clues on economic recovery from the COVID-19 pandemic. Meanwhile, the updates about the US stimulus package and the usual risk catalysts, like geopolitics and the virus woes, will also be key to watch.

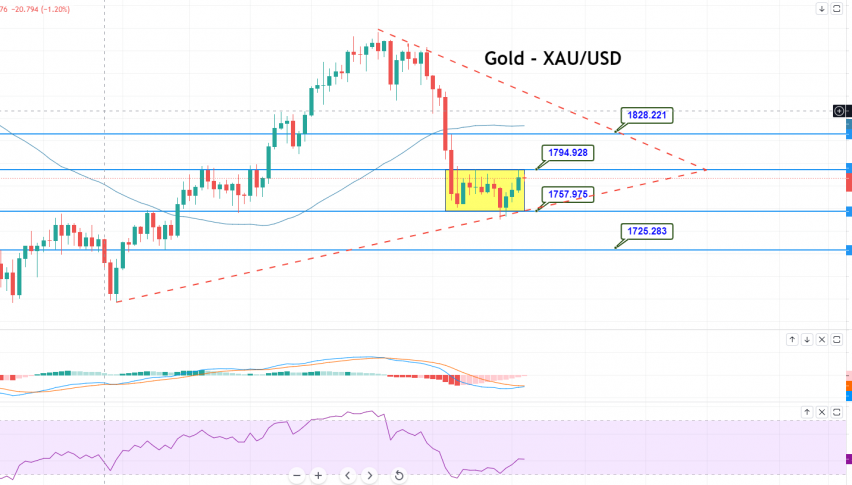

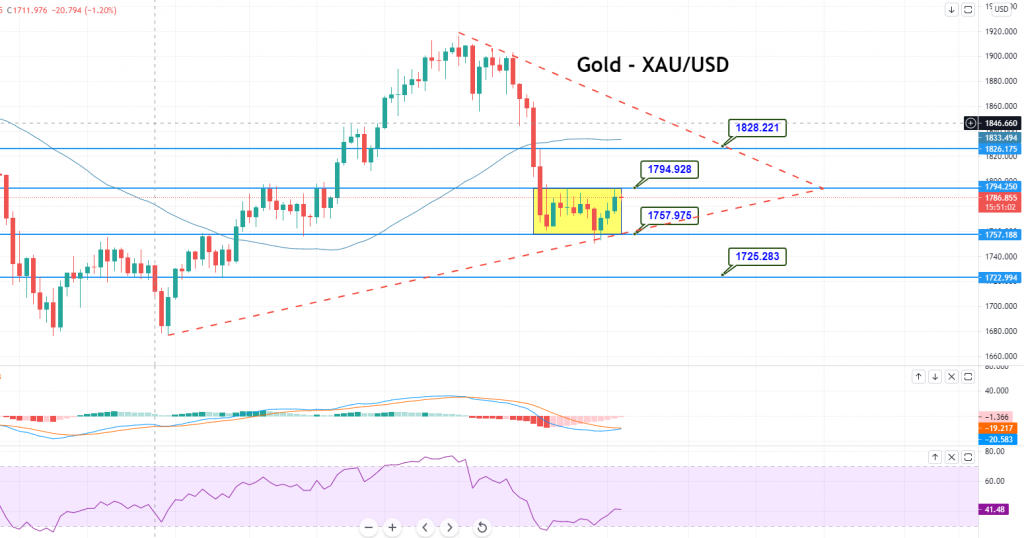

Gold – XAU/USD – Daily Support and Resistance

S2 1,765.27

S1 1,777.05

Pivot Point: 1,786.12

R1 1,797.9

R2 1,806.97

R3 1,827.82

Gold – XAU/USD – Technical Outlook

On Monday, the precious metal, gold, is trading at a 1,787 in a choppy session. It is facing immediate resistance at 1,794, along with a support area of 1,757. A breakout of this range is likely to define further movements in the market. On the higher side, a breakout could lead the gold price towards levels of 1,810 and 1,828. At the same time, the support remains at 1,745 and 1,725. The RSI and MACD are in support of a selling trend. However, it all depends on a breakout at 1,794. A Bullish breakout could offer a buying trade opportunity. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account