Closing Our Long Term EUR/USD Sell Signal Ahead of the FED’s Meeting Minutes

EUR/USD is hanging on above 1.18, waiting for the FOMC meeting minutes later this evening

The long term bullish momentum in EUR/USD seems to have come to an end. Buyers have been having making new highs above 1.2360s since January this year, despite the bounce in Q2. The FED has been keeping the monetary policy extremely accomodative while the US government has also been pouring money, which has been keeping the USD bearish.

But, this pair has shown weakness, as it failed to reach January’s highs, while in the last month it has reversed down. The price fell to 1.1850 last month and bounced off there, but the 200 SMA (purple) turned into resistance on the daily chart and reversed

down, which is another bearish sign.

But, we decided to close our sell forex signal for more than 160 pips, as we head into the FED minutes from the last meeting, where they made a sudden hawkish shift. They mentioned rate hikes which will be on the minutes today, so the market is anticipating it.

The 200 daily SMA rejected EUR/USD after the small bounce

The risk is if FED members argued hard about it which means that the hawkish shift is not too strong. They tried to play down the hawkish reversal already, so we will see today exactly what they discussed. If we see a bounce higher to 1.20 after the FED, then we might open another sell forex signal in this pair. The European Commission released its latest quarterly projections a while ago which were revised higher from the previous projections, but they are not helping the Euro.

EUR/USD Live Chart

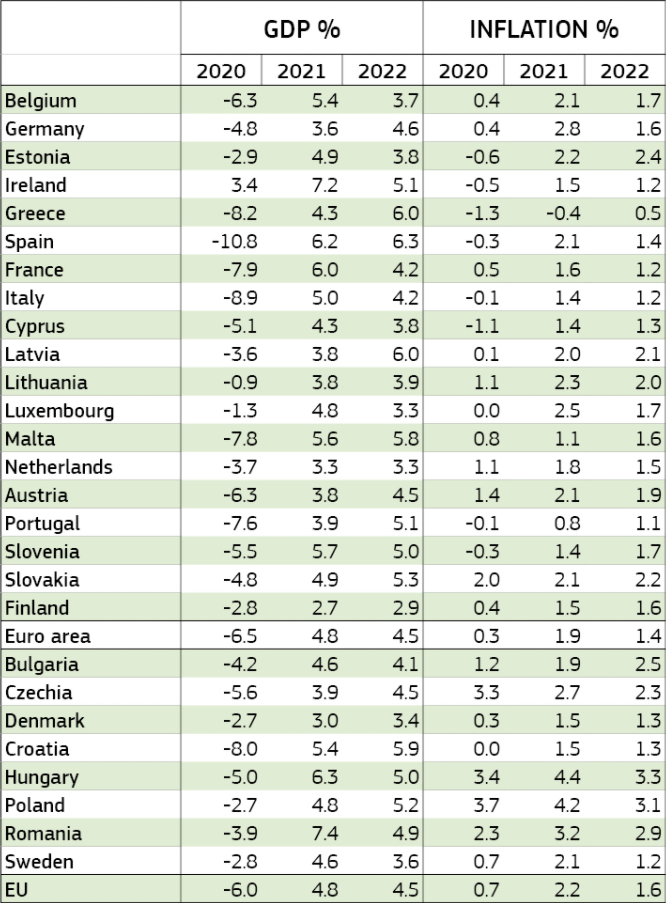

European Commission Quarterly Projections

- Eurozone 2021 GDP growth forecast 4.8% (previously 4.3%)

- Eurozone 2022 GDP growth forecast 4.5% (previously 4.4%)

- Germany 2021 GDP growth forecast 3.6% (previously 3.4%)

- France 2021 GDP growth forecast 6.0% (previously 5.7%)

- Eurozone 2021 inflation forecast 1.9%

- Eurozone 2022 inflation forecast 1.4%

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account