What’s Happening With Polkadot (DOT) on Friday?

Polkadot (DOT) is undergoing somewhat of a price consolidation early on Friday, being weighed down by the risk-off mood in the wider crypto sector, but has still managed to post a weekly gain of over 2% so far. At the time of writing, DOT/USD is trading around $15.19.

While the price has recovered after sliding below the key $15 level, it is trading mostly steady since then, suggesting a strong chance of a breakout in the near future. The gains made so far come from the bullish action seen earlier in the week when market leaders Bitcoin and Ethereum were on the uptick and the positive sentiment across cryptocurrencies was offering strong support.

Since then, however, the sentiment towards digital assets has come under pressure again, especially as regulatory concerns increasingly come back to focus. The latest bearish tones in the market came on the back of reports that Barclays has stopped its UK customers from transferring money to their Binance accounts, days after the FCA announced a ban on the operations of the world’s largest crypto exchange.

Polkadot is also likely to face pressure to the downside over recent analysis by attorney Jeremy Hogan on why the SEC could come after ADA like it has with Ripple’s XRP. Hogan highlighted how the Web3 Foundation conducted multiple rounds of ICOs in 2017 even before the Polkadot blockchain was completely developed and functioning, raising nearly $200 million even before the DOT token actually existed in the market.

On a positive note, however, unlike Ripple, the Web3 Foundation – the firm behind the development of Polkadot’s network is based outside the US and cannot be regulated by the SEC as a result. However, there is some potential gray areas that may be leveraged by the SEC in case it wishes to go after DOT, claiming it to be a security.

Key Levels to Watch

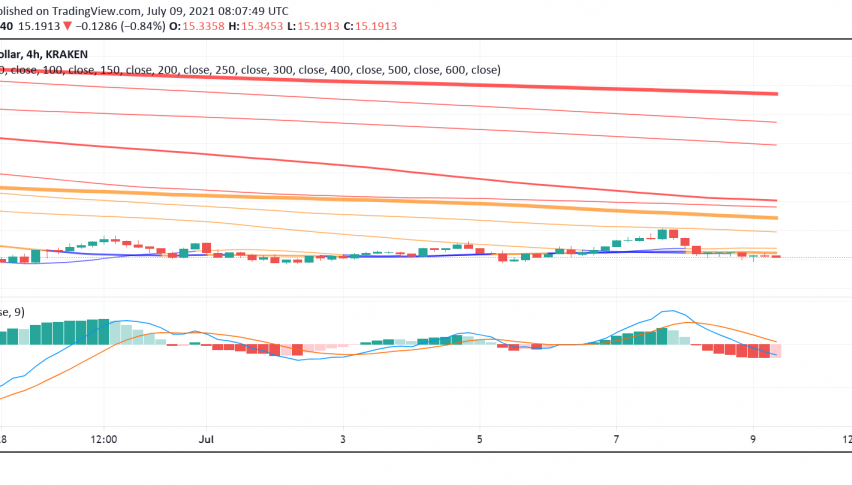

Moving averages and leading technical indicators MACD and momentum are suggesting a bearish bias on the 4-hour chart of DOT/USD. The price is holding just under the pivot point at $15.88 indicating that sellers remain in charge at the moment.

A build-up of further selling pressure can see Polkadot’s price tumble lower to test support at $14.7 and possibly head even lower towards the next support level which sits around $13.42. On the other hand, if the sentiment turns around, we could see buyers jump in and take DOT higher, towards resistance just above the $17 level.