Gold on a Bullish Run – Powell’s Dovish Remarks Push Gold to $1,830

During Thursday’s Asian trading session, the price of the safe-haven metal extended its upward rally of the previous four days, taking some additional bids well above the $1,830 level, as investors digested mixed economic data from China and Australia.

Meanwhile, the mounting concerns over new coronavirus (COVID-19) strains and reflation fears put an additional burden on the market trading sentiment, which has led to further gains in GOLD. Apart from this, the ongoing bullish bias surrounding the gold prices could also be attributed to the escalating US-China tussle, which is worsening constantly, as the US Senate recently passed a bill to ban all products from Xinjiang, China. Besides this, the bearish bias surrounding the US dollar, triggered by the Fed’s dovish tone, was seen as another critical factor that has lent some additional support to the dollar-denominated commodity, (gold).

COVID Variant Woes

US-China Tussle

The tussle between the United States and China is not showing any signs of slowing down; in fact, it is getting worse with time, thanks to the bill to ban all products from Xinjiang, China, which was passed by the US Senate. As per the latest report, the Senate passed the law on Wednesday, banning the import of products from the Xinjiang region in China. The latest effort came in the wake of punishing Beijing for ongoing genocide against Uyghurs and other Muslim groups. It is worth mentioning that the Uyghur Forced Labor Prevention Act constitutes a “rebuttable presumptio,” that assumes all goods manufactured in Xinjiang are produced with forced labor, and therefore banned, according to the 1930 Tariff Act. The negative results of the US stocks futures highlight the risk-off sentiment, which benefits gold, which is a dollar-denominated commodity.

On the data front, the recently released Australian data showed that Employment Change fell below the expected 30.0K and the previous 115.2K and 29.1K in June, while the Participation Rate remains unchanged at 66.2% against 66.3% forecast. On the flip-side, the Unemployment Rate decreased to 4.9% during the stated month, against market expectations of 5.5% and the previous figure of 5.1%. Meanwhile, Aussie Consumer Inflation Expectations for July met the forecasts of 3.7%, compared to the prior 4.0%.

In China, the GDP expanded 7.9% year-on-year, and 1.3% quarter-on-quarter, in the second quarter. Meanwhile, industrial production rose 8.3% year-on-year in June, while the unemployment rate was unchanged at 5%.

Weaker US Dollar and Gold

Despite the risk-off market mood, the broad-based US dollar failed to extend its positive early-day performance, falling to an intra-day low, as the Federal Reserve’s Jerome Powell shrugged off the latest jump in US inflation. He further added that the bank would keep inflation under control by raising interest rates and tapering asset purchases. Therefore, the declines in the US dollar were seen as one of the critical factors that helped the gold prices to stay bid, as the price of GOLD is inversely related to the price of the greenback.

Moving on, the UK monthly Claimant Count Change for June will provide crucial information for market traders. Apart from this, the traders will keep their eyes on the weekly US Jobless Claims and the Philadelphia Fed Manufacturing Index figures. Last but not least, the US dollar price movement will continue to play a vital role in the direction of gold.

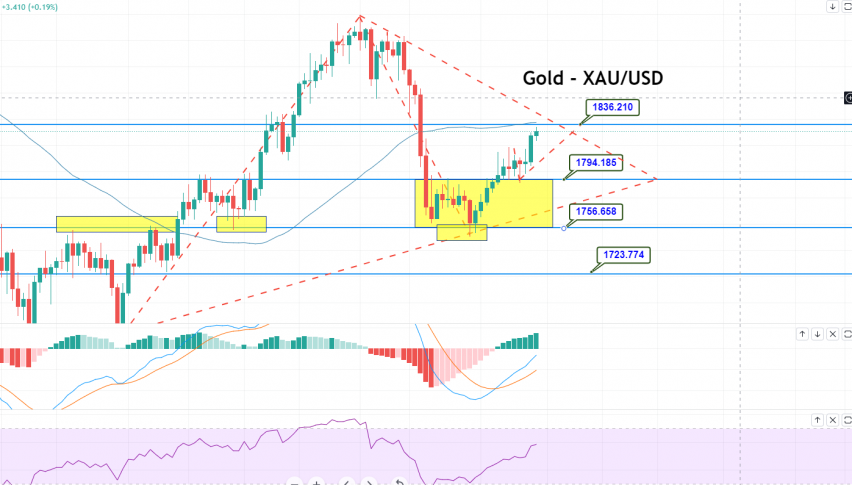

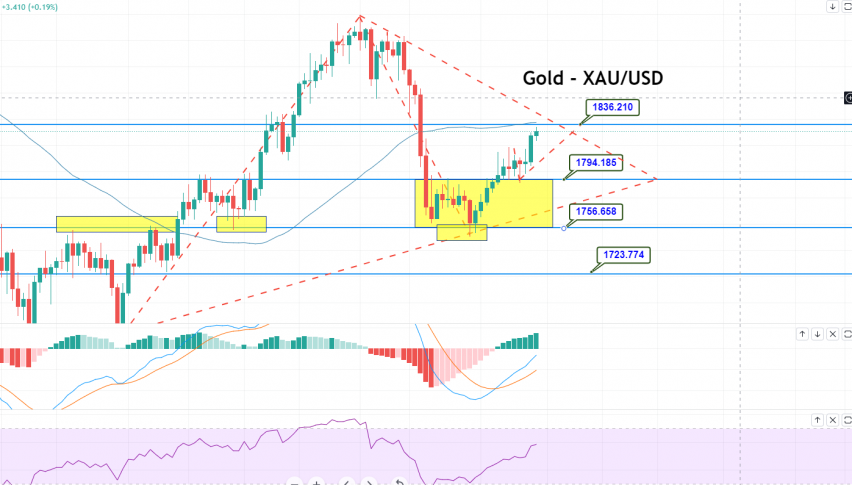

Gold – XAU/USD – Daily Support and Resistance

S2 1802.37

S1 1814.81

Pivot Point: 1822.35

R1 1834.79

R2 1842.33

R3 1862.31

Gold – XAU/USD – Trade Idea

On Thursday, the precious metal, gold, is trading with a bullish bias at 1,830. Gold has mostly traded exactly in line with our Gold’s July 15 Forecast, as it is heading north, towards the 1,836 target level.

On the 4-hour timeframe, gold has closed a bullish engulfing candle that supports a bullish trend, and may lead the price towards 1,836 today.

The MACD and RSI indicators support a buying trend, as the values of both indicators remain within a buying zone, at 7.4 and 58, respectively.

The 50 periods EMA extends an immediate resistance at 1,836, and a bullish crossover could extend the buying trend until 1,863 today.

Stay tuned to the FXLeaders trading signals page for more updates on the GOLD trade. Good luck!