Buying USD/CAD After the Retrace Down, As Retail Sales Remain Negative for May

USD/CAD has formed a bullish reversing patter at the 20 daily SMA

USD/CAD was on a massive bearish trend, which lasted for more than a year, sending this pair from 1.4660s in March last year to 1.20 in May this year. But, that big round level held and the price started to reverse higher. During the decline moving averages were acting as resistance, particularly the 50 SMA (yellow) but the price broke above them all on the daily chart, reinforcing the trend reversal. The 20 SMA (gray) turned into support eventually and has been pushing the price higher for more than a month, holding well during pullbacks lower.

We saw a pullback to that moving average this week, so we decided to open a buy forex signal a while ago. Yesterday, the daily candlestick closed as a doji, which is a bullish reversing signal for USD/CAD after the pullback in the previous two days, so this trade looks good at the moment. The Canadian retail sales report for May, which was released a while ago, showed that sales remained negative that month too, so fundamentals are pointing up for this pair as well. Below is the Canadian retail sales report:

USD/CAD Live Chart

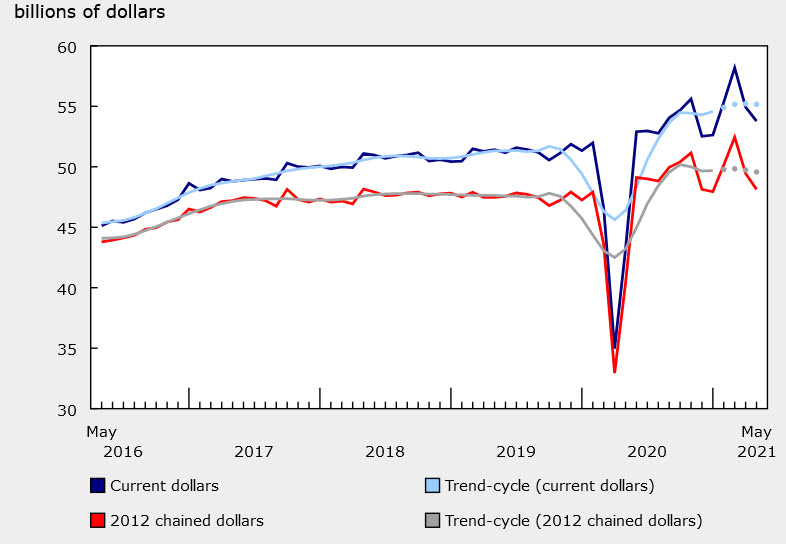

Canada May Retail Sales Report And June Prelim Estimates

- May retail sales -2.1% vs -3.0% expected

- April was -5.7%

- May retail sales ex autos -2.0% vs -2.2% expected

- Sales ex autos and gas -2.4% vs -7.6% prior

- Sales down in May in 8 of 11 subsectors

- 5.6% of retailers were closed at some point in May compared to approximately 5.0% the month prior

- Full report

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account