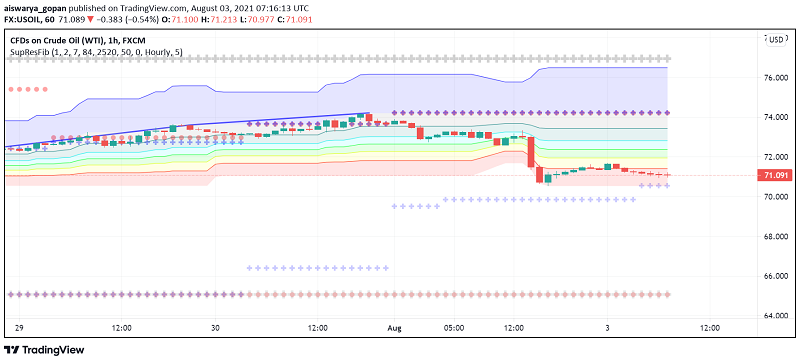

WTI Crude Oil Prices Bouncing Back After Monday’s Steep Fall

WTI crude oil prices seem to be recovering from the strong bearish mood during the previous session, although gains seem to be limited

Early on Tuesday, WTI crude oil prices seem to be recovering from the strong bearish mood during the previous session, although gains seem to be limited as traders worry about the spike in COVID-19 cases around the world and how it could weaken oil demand once again. At the time of writing, WTI crude oil is trading at around $71.09 per barrel.

Crude oil registered sharp losses on Monday after the release of manufacturing PMI data from key economies pointed to a slowdown in activity, especially in China and the US. This caused WTI oil to lose over 3% of its value in a single day, raising concerns that slowdowns in factory activity could dent oil demand.

In addition, investors also worry about the latest resurgence in fresh infections across several countries as it could force governments to announce more restrictions and curbs that could further hurt economic activity and reduce the demand for oil. Cases continue to rise across the US, UK and other countries despite the widespread rollout of COVID-19 vaccines, raising concerns that the progress made towards global economic recovery could suffer.

Crude oil prices are on the rise in the present session over escalating geopolitical tensions in the Gulf region after an attack on an Israeli oil tanker off the coast of Oman. Any tensions in the oil rich region of the Middle East could have a severe impact on oil supply, and the likelihood of supply pressures are lending some support to oil prices at the moment.

In addition, oil is also trading higher over expectations that crude inventories across the US have declined during the previous week. According to a recent Reuters poll, US crude stocks are likely to have fallen by 2.9 million barrels over the past week, declining for the third consecutive week and giving hope to traders that oil demand remains strong across the world’s biggest energy consumer.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account