Stock Markets Remain Bullish, As FED Hesitates on Tapering

Traders have been expecting the FED to announce tapering at some point, but it's not coming yet

Stock markets have been in one of the strongest bullish runs in history since March last year, when they made a reversal up, following a crash lower during the first 2-3 months of 2020. Central banks and governments have carried out the biggest spending programmes in history, worth many trillions of dollars/euros, which has been one of the main reasons why stock markets have been bullish, since large amounts of this cash have been flowing into the stock markets.

But, with the expansion we have seen in the global economy during this year, especially in the US the FED is starting to think about tapering the coronavirus stimulus programmes. If that were to be the case, US stock markets would enter a retreat period on such news.

So many buying opportunities at moving averages for S&P500

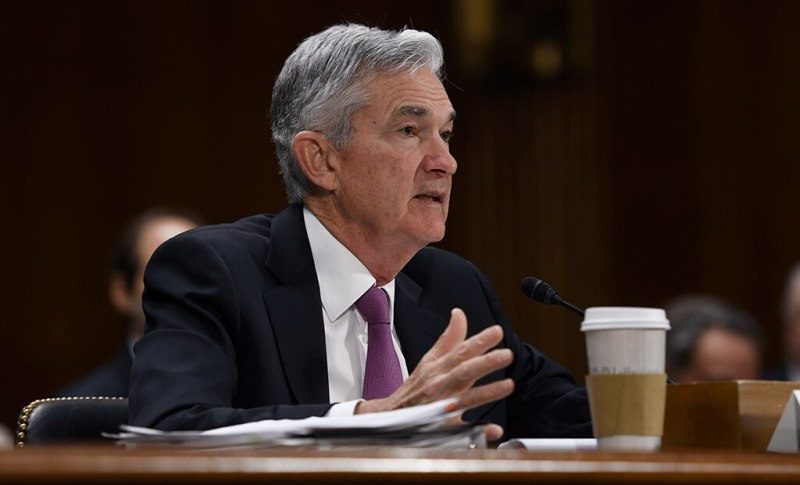

Earlier this week, we saw stock markets retreat lower, as the tapering comments from FED members were increasing, but on Friday we heard FED chairman Jerome Powell play down such comments, due to the delta covid variant. That was what stock traders were waiting and they jumped back in after the comments, sending them higher again on the larger bullish trend. We bought the German DAX index during the pullback, while the S&P500 also looks tempting, so we will keep buying retreats to the moving averages on the daily chart, as soon as the money keeps rolling.

Back on August 11, Fed’s Kaplan said “he was in favor of announcing a plan to taper at the Sept meeting and start tapering in October”. Yesterday, near the start of the NY session, Kaplan in an interview on FOXBusiness said:

- The big “imponderable” is the path of Delta virus.

- So far the Delta virus has not had a material effect on mobility

- Delta virus is limiting production output and slowing return to the office

- Will be watching Delta carefully

- If Delta is having a more negative effect on GDP growth could cause me to adjust my views

That softening of the tone from one of the more hawkish FED president’s, had traders thinking about next week’s Jackson Hole symposium where Fed’s Powell is scheduled to speak. The market has been preparing for the possibility that Powell would use the opportunity to tilt his bias more toward the sooner rather than later side.

However, if Kaplan has reservations, the Fed chair would certainly not change his mind so soon. That is not to say, that the Fed would not start to taper in 2022. It will more likely wait for a clearer picture. The Kansas City Fed just announced that the Summit will be held virtually and NOT face-to-face due to the Delta variant threat. That symbolic action, may be casting the vote for the Fed toward no announced taper now or most likely the September meeting too).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account