Services Cooling off on Covid Fears as Autumn Approaches, but GBP/USD Bounces off 1.36

GBP/USD is 100 pips higher today, while services are cooling off already as we head toward autumn

GBP/USD stopped making new highs in May, and it reversed lower in June, from 1,4250. In July, it broke the 200 SMA (purple) on the daily chart, as the price fell to $1.3570s. This pair moved higher again in the last week of July, but buyers couldn’t push the price above 1.40, which was a bearish sign for the GBP/USD.

Last week, this pair turned bearish again as the USD gained some momentum, even more so than the EUR/USD, resulting in the EUR/GBP climbing 150 pips higher, which is yet another sign of weakness for the GBP. Today, the UK services report showed a decent cool-off from the highs of the last few months, suggesting that this sector will suffer again with the winter restrictions coming up in Britain, due to the growing numbers of virus cases.

GBP/USD Live Chart

Restrictions have become quite predictable now, in the winter time, but the GBP didn’t mind the weaker services report much. The GBP/USD is currently around 100 pips higher, after bouncing off the support zone, but we will try to sell this pair higher, probably below 1.40, since the larger trend seems to have turned bearish now.

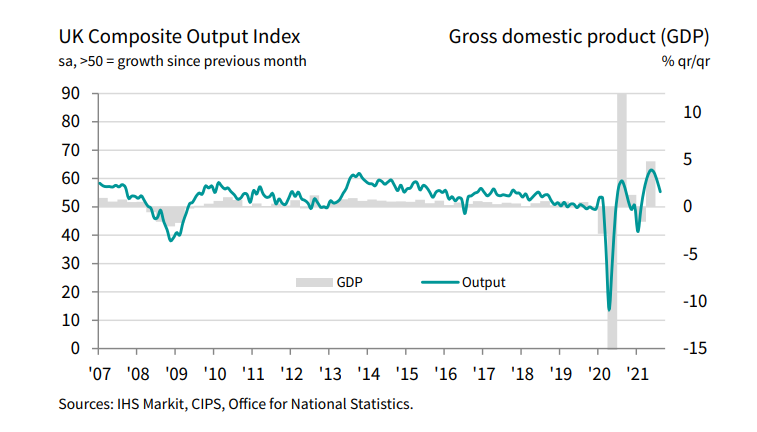

Latest data released by Markit/CIPS – 23 August 2021

- August flash services PMI 55.5 points vs 59.0 expected

- July services were 59.6 points

- Manufacturing PMI 60.1 points vs 59.5 expected

- July manufacturing was 60.4 points

- Composite PMI 55.3 points

- July composite was 59.2 points

That’s quite the miss on the estimated number for the services sector, and the UK recovery momentum has been dealt a hit, amid supply constraints weighing on overall output. Of note, the services reading and manufacturing output index are both down to six-month lows.

“Although the PMI indicates that the economy continues to expand at a pace slightly above the pre-pandemic average, there are clear signs of the recovery losing momentum in the third quarter, after a buoyant second quarter.

“Despite COVID-19 containment measures easing to the lowest since the pandemic began, rising virus case numbers are deterring many forms of spending, notably by consumers, and have hit growth via worsening staff and supply shortages.

“Supplier delays have risen to a degree exceeded only once before – in the initial months of the pandemic – and the number of companies reporting that output had fallen due to staff or materials shortages has risen far above anything ever seen previously in more than 20 years of survey history. In manufacturing, sectors including automotive production and electrical goods have fallen into decline, due mainly to supply constraints.

“Prices have risen sharply again, albeit with the rate of inflation moving below July’s record high, as shortages once again fuelled a sellers’ market for many goods and services and wages rose further. More positively, business expectations for the year ahead perked up in August, encouraging a record jump in employment, as furloughed workers were brought back to the workplace. However, demand and supply availability need to improve further for this rise in employment to be sustained in coming months”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account