Gold Breaks Below Pivot Point 1,792 – Brace for US GDP Figures

Today in the Asian trading session, the yellow metal price failed to stop its previous day's downward rally and remained well offered near

Today, during the Asian trading session, the yellow metal failed to stop its downward rally of the previous day, remaining well offered near the $1,790 level, as the risks surrounding the Delta coronavirus, which could derail the speed of global economic recovery, eased. However, the the situation became less threatening after the US FDA granted full approval to the Pfizer/BioNTech vaccine. The global stock markets flashed mixed signals on the day, which kept traders cautious about placing any strong positions. Despite the strong push for faster jabbing and approval of the vaccines, COVID-19 fears remain on the table.

This was witnessed after Australia’s most populous state, New South Wales, recorded an all-time high in infections. As a result, the S&P 500 Futures fell by 0.15% intraday, to 4,486, declining for the first time in 6 days. The US 10-year Treasury Yields also paused in the run-up to 1.35%, dropping by 0.2 basis points (bps), to around 1.342%. However, the downbeat market mood failed to give any notable support to the safe-haven yellow metal, gold.

Despite the strong push for faster jabbing and vaccine approvals, the market trading sentiment failed to stop its bearish early-day performance and remained well offered on the day, as the risk of the Delta coronavirus variant, which could bamboozle the pace of global economic recovery, is ever-present. The S&P 500 Futures dropped by 0.15% intraday, coming in at 4,486, which was the first decline in 6-days.

In addition to this, the US 10-year Treasury Yields also stopped their run-up to 1.35%, dropping 0.2 basis points (bps) to around 1.342%. It should be noted that the number of infections with the Delta coronavirus variant in China are higher than previously, and the situation in the West is also grim. In addition to the all-time high registered in New South Wales, Australia, New Zealand is also recording daily highs.

The downbeat trading sentiment could also be tied to the reports on the Sino–US talks over equity trading, and chatter about Beijing’s lost economic momentum, which are putting a lot of pressure on the market sentiment. Meanwhile, the cautious mood ahead of the Jackson Hole Symposium, coupled with the US Personal Consumption Expenditure (PCE) data and the second reading of the US Q2 GDP, have also burdened the market trading sentiment. However, gold did not benefit much from the risk-off market sentiment.

The US Dollar & Gold

The broad-based US dollar maintained its bullish bias of the previous-day, drawing some further bids after three consecutive daily pullbacks. The greenback has regained some positive traction and is flirting with the key barrier around 93.00, amidst steady yields and rising cautiousness ahead of the speech by the Fed’s Powell at the Jackson Hole Symposium on Friday. Moreover, the gains were further bolstered by the risk-off-market sentiment, which tends to underpin the safe-haven assets, including the US dollar. So, the upticks in the greenback were seen as one of the leading factors that kept the prices of the precious metal lower, due to its inverse relationship with the US dollar.

Looking forward, market traders will keep their eyes on the Fed’s Jackson Hole symposium, which will open later today. Fed Chairman Jerome Powell is expected to deliver a speech at the symposium on Friday. Increasing numbers of Fed officials have indicated that asset tapering could start earlier than expected; however, COVID-19 outbreaks globally continue to cloud the economic outlook and cast doubts over this view. The headlines over the Sino-US tussle and the Taliban-Afghanistan matter are still playing a major role, and will also be essential to watch.

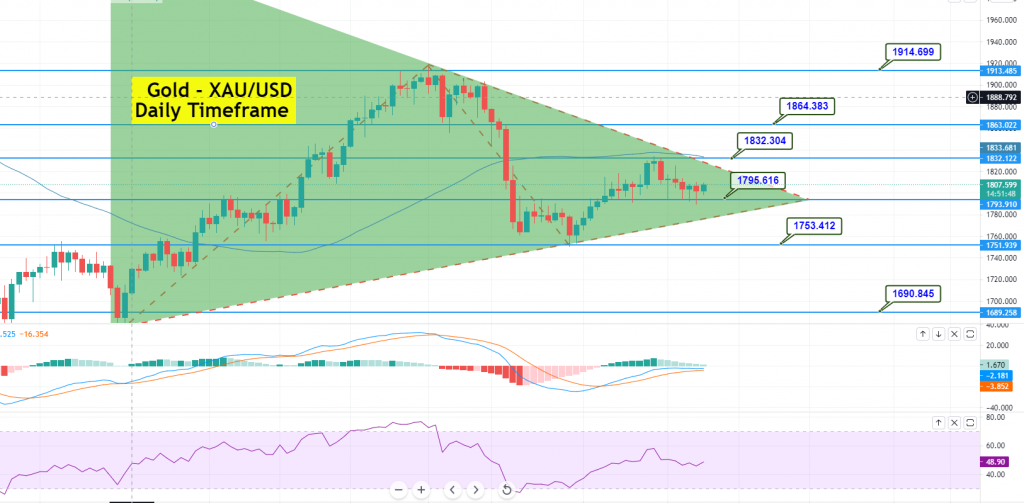

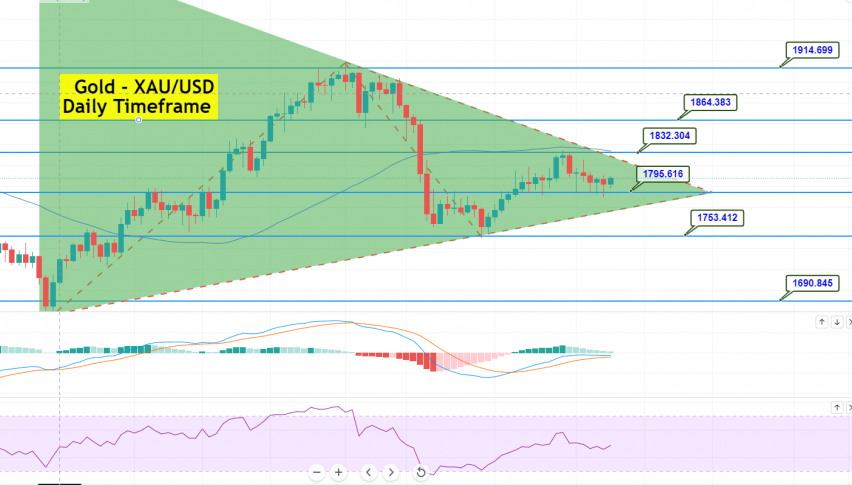

Gold (XAU/USD) – Technical Outlook

The yellow metal is currently trading with a negative bias at the 1,787 level, after being denied at the 1,791 resistance mark. The intraday pivot point level of 1,791 has been violated on the 4-hour timeframe, exposing gold prices to the next support mark of 1,780. A breakout at the 1,780 support level would expose gold to a 1,771 support zone to the downside.

A breakout at the 1,780 support level will open the precious metal to a 1,771 support zone to the downside.

Daily Support and Resistance

S2 1,795.48

S1 1,799.13

Pivot Point: 1,804.41

R1 1,808.06

R2 1,813.34

R3 1,822.27On the upside, a breach of the 1,791 resistance mark would open the GOLD price to the 1,801 level, with the 1,808 level serving as the next resistance. Because the value of the RSI has reached the oversold zone, failure to breach the 1,780 support increases the chances of a bullish correction. The major focus will be on the US GDP and the Jackson Hole Symposium later today. Best wishes!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account