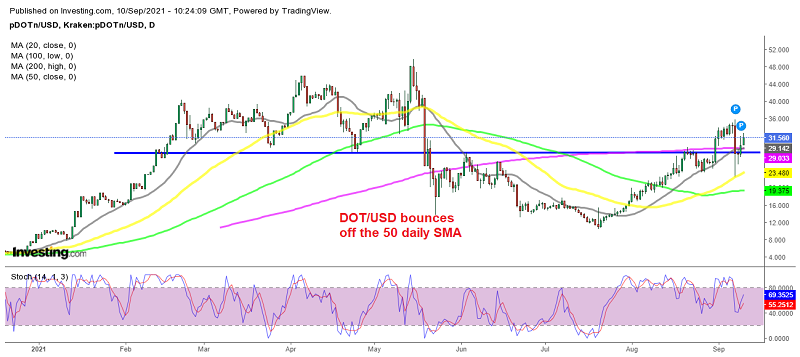

Polkadot (DOT) Coin Analysis – DOT/USD Back on the Uptrend?

Polkadot (DOT) has bounced off the 50 daily SMA and is looking bullish again

Polkadot has shown some resilience since late July, making decent gains. This crypto turned really bearish during the decline in the cryptocurrency market, making lower lows and losing a total of around 80% of its value. But, since the reversal in the market in July, Polkadot has been quite bearish, even more so than the rest of the market.

DOT/USD was trading just above $10 less than two months ago, while earlier this week it was trading above $35, which means a 350% gain. The 20 SMA (gray) turned into support in August, pushing the price above the 200 SMA (purple) and the support and resistance zone around the $30 level.

Polkadot Live Chart

That’s more than the gains in the majority of the market, but the crash came on Tuesday, the day that El Salvador made Bitcoin legal currency in the country. Polkadot coin lost a third of its value, falling to $22.80, but the 50 SMA (yellow) held as support on the daily chart.

The decline stopped right at that moving average, and it didn’t take long for Polkadot to resume the bullish trend again. On Wednesday, the price formed a hammer/Doji candlestick, which is a bullish reversing signal after the decline, and yesterday, DOT/USD moved above $30.

Polkadot Trade Idea

So, buyers are in control again in Polkadot, and the developments in this crypto point to further demand for DOT coins. Polkadot is going ahead with the second edition of Kusama Parachain slot auctions, which has increased the competition (and will do so even more in the future) from developers with blockchain projects.

So, Polkadot will continue to increase, and the next targets are $35 and then $50, which is the all-time high. We are not trading Polkadot at the moment, but if we see another dip to the 50 daily SMA, we will try to catch the move and open a buy signal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account