Buying GBP/USD as BOE Looks to Reduce QE

The GBP will probably turn bullish soon as the BOE is beginning to give hawkish signals

During the pandemic period, the Bank of England (BOE) has been extremely dovish, like all central banks. With its QE (quatitative easing) program, it cut interest rates and threw extensive amounts of cash into the economy during the coronavirus crisis.

But, after the other central banks, like the FED, started reducing QE, and with the ECB also looking to wind down some of the cash programs, the BOE is following in their footsteps. It seems like they know that there won’t be many restrictions in the coming winter, which would send the economy into another recession. But, they’re looking to reduce the cash handouts, so the UK is unlikely to see further lockdowns.

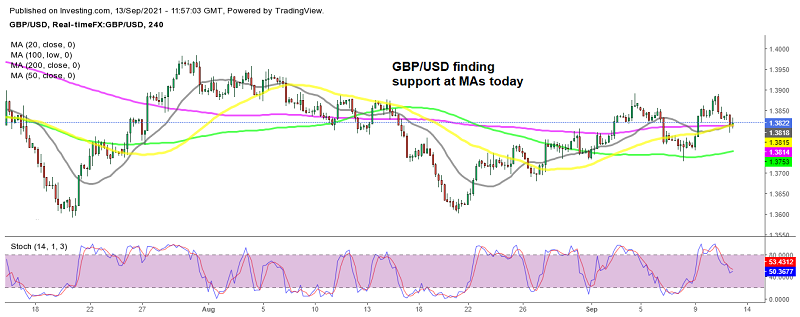

GBP/USD Live Chart

GBP/USD

Remarks by BOE executive director for markets, Andrew Hauser

- Unwinding QE will become an integral part of future tightening strategies

- Balance sheet will be structurally larger in the future, even after QE unwinds

Remarks by the German Ministry of Economic Affairs

- Q3 GDP growth to pick up significantly after 1.6% q/q growth in Q2

- GDP growth likely to normalise in Q4

Peak conditions in the early stages of the summer set up a good look for Q3 performance, but the latter stages are pointing to moderation in overall conditions, even more so in the outlook, as optimism fades and pent-up demand abates.

While a return to renewed virus restrictions may not be on the cards, there are still worries on the spread of the delta variant, which is keeping a cloud over the outlook in Q4.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account