NZD/USD Looks Uncertain After the Jump in Q2 GDP Figures

NZD/USD is still uncertain despite the positive GDP report for Q2

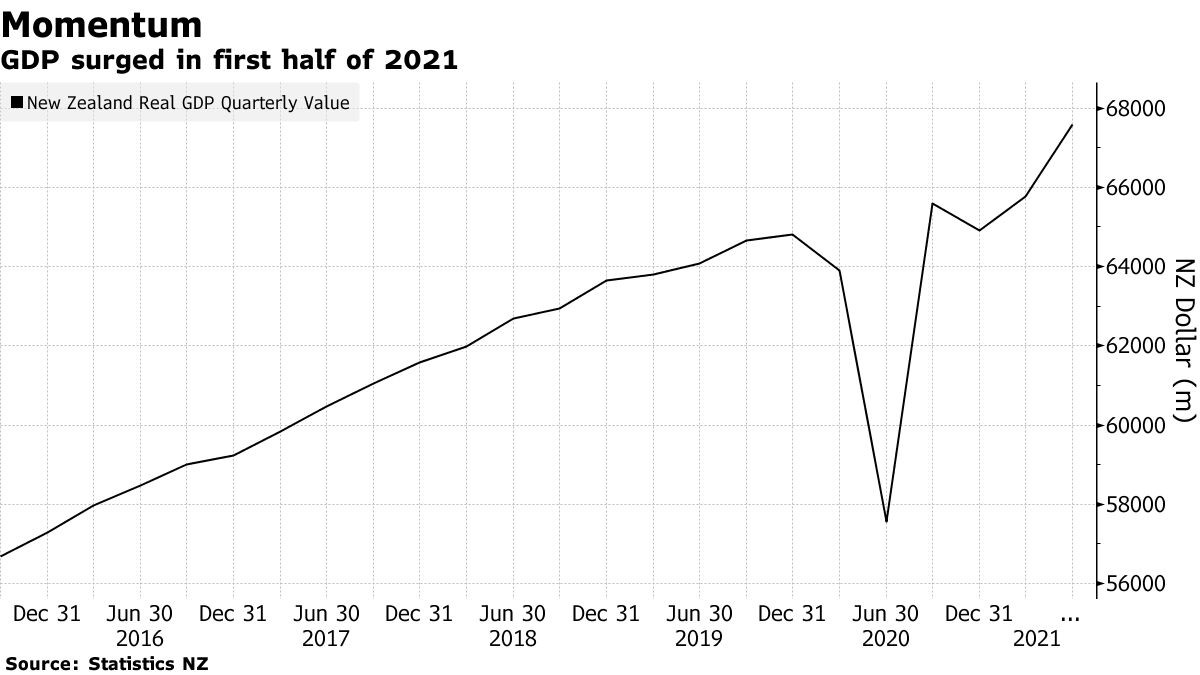

The NZD/USD has been one of the most bullish pairs in recent weeks, as the NZD kept making gains against the USD, following the rate hike from the Reserve Bank of New Zealand in the previous meeting. NZD/USD has gained nearly 4 cents since late August, and it is holding onto those gains, while other currencies have turned bearish against the USD in September.

NZD/USD has remained uncertain, trading sideways for more than a week, since the RBNZ will have to rethink whether to continue increasing rates or keep them on hold, given the COVID restrictions in East Asia and that part of the world. The Q2 GDP number was impressive, but it is a bit outdated as well, so the uncertainty remains for the Kiwi.

NZD/USD Live Chart

New Zealand Data, Q3 2021 Economic Growth

- GDP Q2 2.8% 1.4 vs 1.4% expected

- Q1 GDP was 1.6%, revised to 1.4%

- GDP YoY 17.4% vs expected 16.3%,

- Prior DGO YoY was 2.5%, revised to 2.4%

The beat confirms the strength of the New Zealand economy heading into Q3, and it all but locks in a Reserve Bank of New Zealand rate hike, with more to follow. The next RBNZ meeting is on October 6.

What Analysts Are Expecting Regarding RBNZ Action

- April to June data is quite old hat now, especially given the renewed COVID-19 outbreaks and lockdown responses, which will weigh on Q3 data. Nevertheless, the data should confirm the NZ economy heading into Q3 with impressive momentum.

- While the figures are dated … the data is likely to suggest a more positive output gap and higher underlying inflationary pressure just before the latest COVID-19 outbreak.

- Even though we know that growth in the current Q3 quarter will be dire, owing to the lockdowns, a strong rebound thereafter would add to the sense that the OCR needs to head a lot higher, adding to the conviction for rate hikes ahead.

- Our forecast is at the upper end of the market range, and substantially higher than the Reserve Bank’s estimate of 0.7%. A result in line with our view would bolster the case for removing some monetary stimulus

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account