S&P500 Trade in Profit, As the Index Opens Higher After Lower US Employment

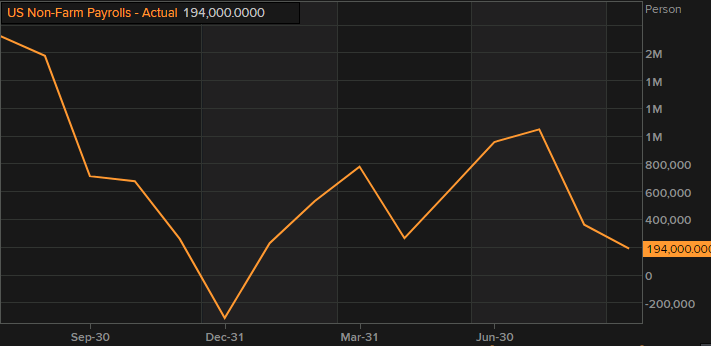

US non-farm employment cooled off again in September, sending stock markets higher

Stock markets have been on a retreat since the beginning of September. The price slipped below the 20 SMA (gray) and the 50 SMA (yellow) on the daily chart, which has been acting as support. We decided to go long, but the retreat continued below the 100 daily SMA (green), which is only the second time it happened and it reached our SL target.

We opened another buy signal/trade on S&P500 and now we are seeing a fight from the buyers. The retreat was due to the Chinese economy going into another period of weakness, with services in contraction already from the coronavirus restrictions. Although, that might not repeat in the West, so traders and investors are getting used to this idea and they are fighting back.

The price has climbed above the 100 SMA and today S&P opened with a gap higher, after the US employment change for September came much lower than expectations. That means that the FED might stay loose for a longer period of time, so some of this cash will flow into stock markets.

US September 2021 Non-Farm Payrolls Report:

- September non-farm payrolls +194K vs +500K expected

- Prior was 235K (revised to +366K)

- Two month net revision +194K

- Unemployment rate 4.8% vs 5.1% expected

- Prior unemployment rate 5.2%

- Participation rate 61.6% vs 61.7% expected (was 62.8% pre-pandemic)

- Prime age participation to 81.6% vs 81.8% prior (83.0% pre-pandemic)

- Prior participation rate 61.7%

- Underemployment rate 8.5% vs 9.0% expected (8.8% prior)

- Average hourly earnings +0.6% m/m vs +0.4% expected

- Average hourly earnings +4.6% y/y vs +4.6% expected

- Average weekly hours 34.8 vs 34.7 expected

- Change in private payrolls +317K vs +455K expected

- Change in manufacturing payrolls +26K vs +25K expected

- Long-term unemployed at 2.7m vs 3.2m prior

- The employment-population ratio, at 58.7% vs 58.5% prior (61% before pandemic)

The revision to August upwards by 131K and the better unemployment rate takes a bit of the sting out of the report but it’s not a great number by any stretch. Another notable detail is the big improvement in the number of long-term unemployed (those jobless for 27 weeks or more) which decreased by 496,000 in September to 2.7 million. That had been stuck at high levels.

On the wage side, the wages numbers were a tad hot and that fits in with anecdotes. We will get the JOLTS data later.

In August the ‘leisure and hospitality’ component was poor on the covid resurgence and the bounce was mediocre in this report with 74K jobs added. Last month there were 42K job losses in food services and drinking places and that hasn’t rebounded with few jobs added. The number of jobs in leisure and hospitality is down by 1.6m relative to Feb 2020.

Powell said this report needs to be ‘reasonably good’ to taper in November. Is this good enough? Probably but it could slow the pace to something like $15B from $20B. That will be the next big debate.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account