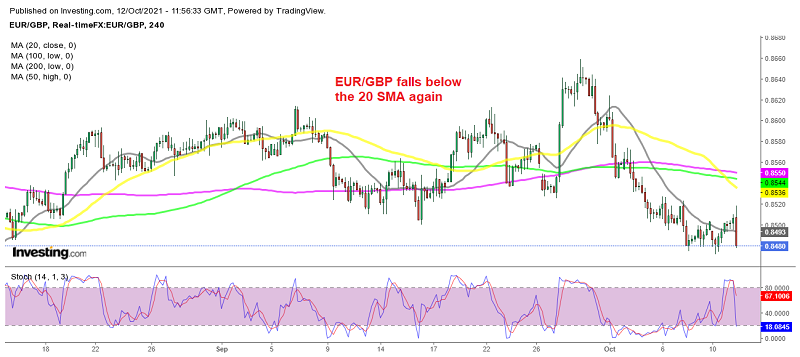

EUR/GBP Reverses Down After UK Earnings Keep Surging, While EU Economic Sentiment Deteriorates

The UK earnings keep surging, while Eurozone ZEW economic sentiment keeps declining

The economic sentiment in the Eurozone has turned lower since June. It peaked at 84.4 points in May, but it has cooled off and in today’s report this indicator fell to 23 points from the EU and Germany as well. This shows that the good times are ending in Europe and they were short-lived.

Now we head into the winter period and the restrictions might come back again. The earnings in the UK remain pretty high, despite a cool-off in September to 7.2%, which is incredibly high nonetheless. The diverging data has forced EUR/GBP down and our sell signal here is in profit now. Below are the two reports:

UK Employment and Earnings Report from ONS – October 12

- September jobless claims change -51.1K vs -58K prior

- July ILO unemployment rate 4.5% vs 4.5% expected

- June unemployment rate was 4.6%

- July employment change 235k vs 243 expected

- June employment change was 183k

- July average weekly earnings +7.2% vs +7.0% 3m/3m expected

- June earnings were +8.3%

- July average weekly earnings (ex. bonus) 6.0% vs +6.0% 3m/3m expected

- June earnings ex. bonus were +6.8%

This was expected to show a dip in the unemployment rate and a slight slowdown in wage growth. Unemployment did dip lower in line with expectations at 4.5%. Earnings were higher, but the ONS caution about relying on their calculation due to COVID-19 impacting factors.

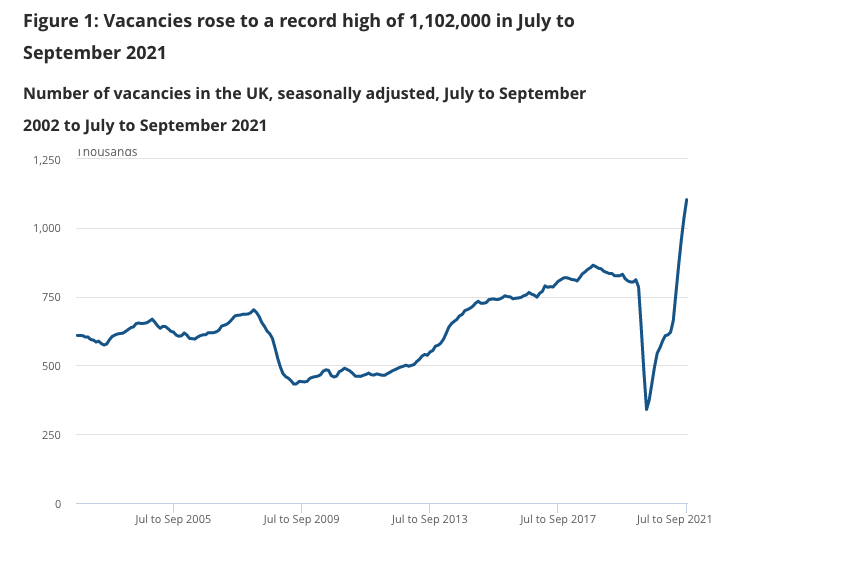

The real test is when the job furlough scheme is not supporting the data. Nothing to note here and the GBP unfazed here. Interest rate rises and Brexit talk is the main risk for GBP volatility now. Vacancies are at a record high at 1.102 million in July to Sep

ZEW Economic Sentiment Report – October 12

- Germany October ZEW survey current conditions 21.6 points vs 31.9 prior

- Outlook 22.3 points vs 24 expected

- September outlook was 26.5

- Eurozone October ZEW economic sentiment 22.3 points vs 23.7 expected

- September sentiment was 26.5 points

Going into the meeting the question is whether confidence would continue to wane in Germany. Supply chain issues, low gas storage, and surging energy costs are all difficult headwinds not just for Germany, but Europe as a whole.

A worse reading as those risks continue to weigh more strongly on the eurozone. Supply chain bottlenecks blamed by ZEW and EURGBP seeing some weakness now. This should help the EURGBP lower as the bond yield spread between the EU and the UK widen.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account