Further Signs the US Economy Is Accelerating

ISM services and ADP employment reports showed further expansion in the US economy

The US economy softened a little in summer after the surge in Q2, but it seems like it has left behind that soft patch. All indicators keep showing week after week since September that all sectors are booming once again and today ISM services jumped to 66.7 points. The USD hasn’t made most of this expansion but will pick up pace once the FED starts expecting this. Below are the ISM service and ADP employment reports, both of which are quite positive, showing an improving jobs market as well.

October ISM Service Sector Survey

- ISM services index 66.7 points vs 62.0 expected

- September ISM services were 61.9 points

- Employment 51.6 points vs 53.0 prior

- New orders 69.7 points vs 63.5 prior – record high

- Prices paid 82.9 points vs 77.5 prior – highest since 2005

- Business activity 69.8 points vs 62.3 prior

- Backlog of orders 67.3v vs 61.9 prior

- New export orders 62.3 points vs 59.5 prior

- Imports 53.3 points vs 47.7 prior

- Inventories 37.3 points vs 46.1 prior

This is significantly stronger than expected and points to a sharp acceleration in service sector activity.

- “Manufacturers are failing to keep up with orders, and backlogs continue to grow. We’ve seen proposed pricing increases of more than 20 percent in areas of equipment manufacturing. This is extremely concerning.” [Accommodation & Food Services]

- “Container delays are causing serious implications for our supply chain.” [Agriculture, Forestry, Fishing & Hunting]

- “Supply chain disruptions continue to roil new residential construction. Material and skilled labor shortages are lengthening cycle times and forcing substitutions.” [Construction]

- “Supply chain backorders. We have to forecast six months out for basic supplies and one year for larger international equipment orders. Ivy [League] or elite higher education institutions will fare better than smaller schools, as applicants find alternative sources of education.” [Educational Services]

- “Gross revenue continues to be strong due to high patient volume and inpatient census. At the same time, staffing continues to be a challenge and is driving significant cost overruns. To ensure we have adequate staff to care for increased patient demand, we are reliant on higher levels of temporary staff and incentivized staffing programs.” [Health Care & Social Assistance]

- “Everything – from sales demand to orders to manufacturers, domestic and international – is ramping up. The international freight crisis is a critical problem, from capacity to transit times with port delays and costs now reaching three times pre-pandemic levels. Fourth-quarter holiday peak sales are at risk for delayed supply. Labor is still an issue, as it’s hard to find and get people who want to work, especially in services, trucking and warehouse fulfillment. Profitability outlook is down, thanks to rising costs, lower sales and reduced on-time supply.” [Information]

- “While new opportunities continue to present themselves, we are turning work away due to delayed shipments from suppliers and the general lack of new workers.” [Management of Companies & Support Services]

- “Positive indications that have been building in the last couple of months are continuing into the beginning of this quarter.” [Professional, Scientific & Technical Services]

- “Deliveries are significantly delayed. Metals continue to be volatile.” [Public Administration]

- “Construction remains quite strong, although material supply issues persist.” [Real Estate, Rental & Leasing]

- “In general, we still have very strong business activity throughout our business channels. This is despite a very challenging business environment of increasing costs, a very difficult employee retention and hiring environment, and massive logistical backlogs. These issues have forced us to lower our top-line sales forecast slightly, due to a lack of supply and throughput challenges. Where possible, we are looking for substitute products to sell. We are still projecting to be well above last year for the month.” [Wholesale Trade]

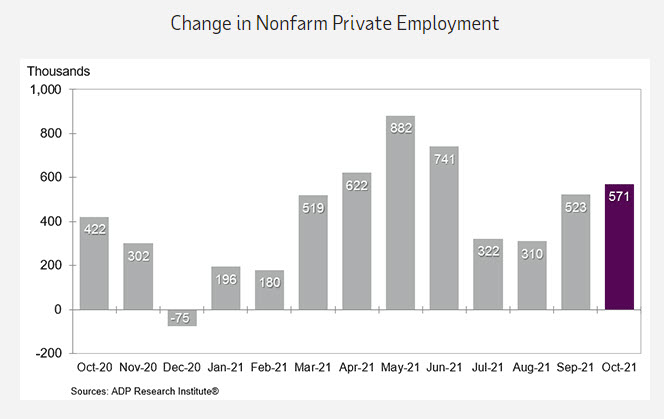

The October 2021 US ADP Employment Report

- ADP October US employment 571K versus 400K estimate

- September report 568K revised to 523K

- Small business 115 K

- Mid-sized businesses 114 K

- Large businesses 342K

- Goods-producing +113 K

- Service-producing +458K

- Leisure and hospitality +185K

- Manufacturing +53K

- Professional/business services +88K

- Trade/transportation/utilities +78K

- Education/health services +56K

- Construction +54K

- Natural resources and mining plus 6K

- Financial activity plus 15K

- Information plus 14K

The US nonfarm payroll estimate is expected at 455K on Friday. The ADP has had a poor track record of predicting nonfarm payrolls. Last month estimate of 568K (revised to 523K) was still higher than the BLS report of 194K. Pre-pandemic, the ADP report was within 65K of the BLS report. During the pandemic the margin of error surge to 774K. The year to date deviations is down to 266K but still quite a ways from the BLS estimate.

Nela Richardson, chief economist, ADP said:

“The labor market showed renewed momentum last month, with a jump from the third quarter average of 385,000 monthly jobs added, marking nearly 5 million job gains this year. Service sector providers led the increase and the goods sector gains were broad based, reporting the strongest reading of the year. Large companies fueled the stronger recovery in October, marking the second straight month of impressive growth”

Mark Zandi, chief economist of Moody’s Analytics, said,

“The job market is revving back up as the Deltawave of the pandemic winds down. Job gains are accelerating across all industries, and especially among large companies. As long as the pandemic remains contained, more big job gains are likely in coming months.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account