The 100 SMA Stops the Bounce in Oil at $82.50

Crude Oil is having second thought at the 100 SMA after the strong bounce off the 200 SMA last Friday

Crude Oil has been in the strongest bullish run ever since April last year. We saw some incredible price action in Crude Oil last week. The price fell from around $85 to below $80 then we saw a bounce to $83.30. But that bounce reversed pretty quickly after finding resistance at the 50 SMA (yellow) on the H4 chart and the price fell to $78.30s, where it met the 200 SMA (purple) which provided support, despite being pierced.

The price bounced off that moving average and climbed more than $4 higher, as OEPEC+ didn’t offer to increase the production uoas further, as the US had requested, while sticking to their plan. but the 100 SMA (green) has turned into resistance now and the price of US crude Oil is starting to reverse back down again.

US WTI Crude Oil Live Chart

The stochastic indicator is also overbought which means that this latest bullish wave is complete and now we should see a retreat down. If the retreat takes the price down to the 200 SMA again, then that would be a good place to look for longs in WTI Oil. But, I don’t know if sellers will reach that level, because the $1 trillion infrastructure bill in the US which may boost growth and demand for fuel, Below is the Eurozone Sentix index which turned positive this month and should be another positive factor for Oil prices.

Latest data released by Sentix – 8 November 2021

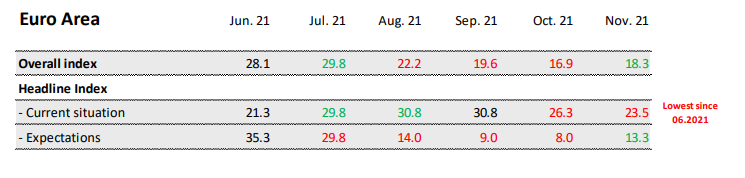

- November Sentix investor confidence 18.3 points vs 15.5 expected

- October Sentix investor confidence was 16.9 points

Euro area investor morale climbed for the first time since July as investors appear to expect that supply bottlenecks and higher prices to hold back the economy temporarily. The current conditions index fell from 26.3 in October to 23.5 in November though, its lowest figure since June but the expectations index moved up from 8.0 to 13.3.

Sentix notes:

“Supply bottlenecks and high inflation are causing problems for companies and are having a certain braking effect. However, investors only expect a temporary burden and are therefore somewhat more confident about the next six months.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account