Gold Retests $1,782 Support – Can XAU/USD Hold Key Support?

The XAU/USD extended its previous session's bullish bias and took some further bids around the 1,785.00 mark, amid inflation risks that the

The XAU/USD extended its bullish bias of thee previous session, taking some further bids around the 1,785.00 mark, amid inflation risks that the Federal Reserve highlighted in a recent speech. Thus far, the XAU/USD has risen from a low of $1,780.88, to a high of $1,786.65, in Asia. Despite the new coronavirus Omicron subtype and less emphasis on the job market, the Federal Reserve’s tilt toward inflation should benefit the gold bugs. The recent Fed rhetoric has increased market volatility, which is good for [[gold]] but terrible for equities and riskier asset classes.

In the meantime, markets are digesting a mixed US report and considering its implications for the Federal Reserve’s next move. Aside from Fed-related talk, gold prices were also influenced by the spread of the South African COVID strain known as Omicron, and discussions surrounding the US-China trade war. The XAU/USD is currently trading at 1,784.32, and consolidating in the range between 1,780.79 and 1,787.73.

Meanwhile, the ANZ reports that China’s Premier, Li Keqiang, has promised a Reserve Requirement Ratio (RRR) cut to the International Monetary Fund (IMF), but he did not specify a date. US intelligence suggests that “China intends to construct its first Atlantic military facility in Equatorial Guinea,” according to recent headlines from the Wall Street Journal (WSJ). The possibility has sounded the alarm in Washington. ”

Furthermore, the yellow metal also benefited from a dramatic reduction in November’s US Nonfarm Payrolls (NFP) statistics, which came in at 220K, which was under the 550K forecast from the day before. On the other hand, the unemployment rate fell by 0.4 percent, to 4.2 percent, while average hourly earnings matched the 4.8 percent YoY projection. The US dollar had a knee-jerk reaction to the news before resuming its uptrend, as Fed fund futures soared.

On the USD front, the broad-based US dollar was supported by concerns regarding the Omicron COVID-19 variant and forecasts of more hot US inflation data, which put upward pressure on interest rates. While anticipating the slide in the unemployment rate, the dollar shrugged off an unexpected decline in US nonfarm payrolls (NFP), whereas the comments by St. Louis Fed President James Bullard, who will also be a voting member in 2022, have also kept the Fed rate hike predictions in the spotlight. As a result, the bullish bias in the US dollar is limiting gains in the XAU/USD. The US Dollar Index, which tracks the greenback against a bucket of other currencies, has risen by 0.16% to 96.270.

A light calendar and a cautious sentiment ahead of the Federal Open Market Committee (FOMC) meeting next week may pose a challenge to gold price movements. We need to monitor the US Consumer Price Index (CPI) for November, the coronavirus headlines and the central bank comments this week.

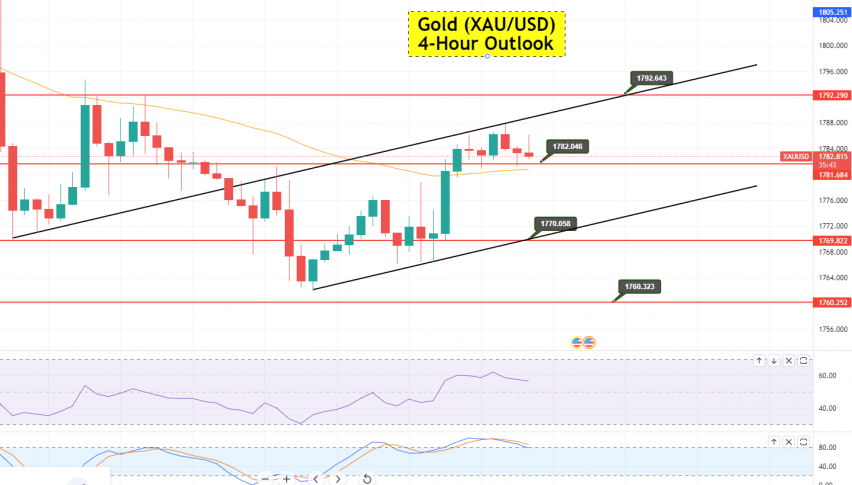

Gold – A Technical Outlook – XAU/USD slips below $1,778

Daily Support and Resistance

S2 1,758.53

S1 1,771.1

Pivot Point 1,778.65

R1 1,791.23

R2 1,798.78

R3 1,818.9On the flip side, violation of the $1,782 level could trigger a sell-off until the 1,769 support. The RSI is holding above 50, and demonstrating a bullish reversal in [[gold]]. Therefore, we should consider taking a buy trade above the $1,781 level, to target $1,792 today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account