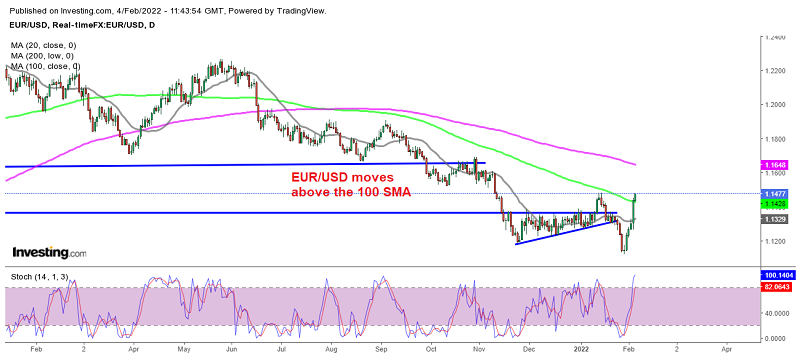

Strong Bullish Reversal in EUR/USD, With the ECB Expected to Hike by 50bps in 2022

EUR/USD is now heading for 1.15 after the hawkish ECB remarks yesterday

The EUR/USD turned bearish in summer last year, as inflation increased above 5% in the US, which started to get the FED worried that it was getting out of hand. The FED started turning hawkish last year, as it began planning to end the QE program, winding it down by $15 billion a month

Now, expectations are that the FED will hike rates by at least 0.75%, starting with a 50 bps rate hike next month. Inflation has been growing elsewhere too, but it is way below the level in the US, where CPI (consumer price index) inflation has increased to 7.2%. But markets also seem to be getting excited about the fact that the ECB is turning hawkish too. They are expected to hike rates by 0.50% by the end of the year, and the Euro has turned bullish, so the EUR/USD has climbed around 350 pips in a strong reversal.

The main criterion laid out by the ECB is that they will only hike after ending APP purchases, and unless they want to risk the bond market throwing a fit, they have to manage those expectations well going into the March meeting. I can see the case for a rate move in Q3 or Q4, should inflation pressures continue to keep getting higher, but otherwise, this would certainly be quite a drastic shift by the ECB if they do proceed, compared to how markets are pricing things in at the moment.

EUR/USD Live Chart

ECB CPI Survey of Professional Forecasters – 4 February 2022

- Eurozone inflation seen at 3% in 2022 (ECB projection 3.2%)

- Eurozone inflation seen at 1.8% in 2023 (ECB projection 1.8%)

- Eurozone growth seen at 4.2% in 2022 (ECB projection 4.2%)

- Eurozone growth seen at 2.7% in 2023

It is interesting to note that the longer-term inflation expectations for 2026 were revised upwards to 2.0%, from the previous round. If anything else, this is likely to just underscore the ECB’s conviction after yesterday’s hawkish shift. But perhaps they have already accounted for the survey results above.

Eurozone December Retail Sales

- December retail sales MoM -3.0% vs -0.5% expected

- November retail sales +1.0%

- Retail sales YoY +2.0% vs +5.1% expected

- Prior sales YoY +7.8%

Euro area retail sales were much weaker than estimated in December, as rising consumer inflation may be starting to take its toll on spending/consumption, despite the Christmas shopping season. Retail sales of non-food products fell by 5.2% for the month, while internet sales were down by 3.9% for the month.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account