The Euro started to turn bearish last summer, as the USD started to gain strength, as the FED started to turn hawkish on surging inflation. Inflation has picked up in Europe as well but it’s way behind the US and the European Central Bank ECB is behind the FED in tightening the policy. The ECB is behind the Bank of England as well, after the BOE already increased interest rates twice in the last two meetings.

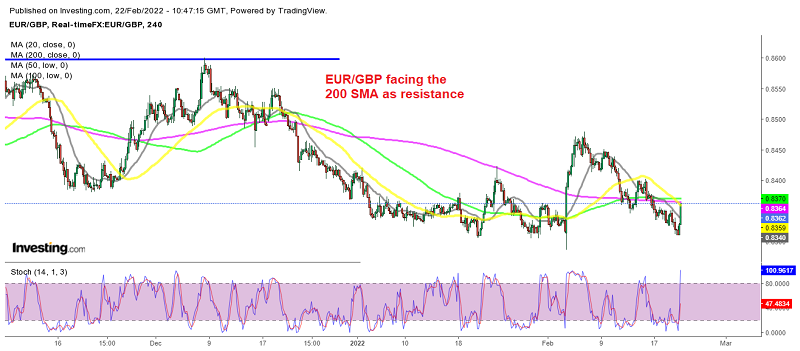

As a result, EUR/GBP has been bearish as well, alth0ugh we are seeing a jump today after the German Ifo business climate increased again this month as the coronavirus wears out and the country comes back to normal. Although, we’re still keeping the bearish bias for this pair, since the UK has removed restrictions as well and the BOE has already hiking rates, while the ECB is still thinking about it. Below is the German ifo business climate report.

EUR/GBP Live Chart

Latest data released by Destatis – 22 February 2022

- Germany February Ifo business climate index 98.9 points vs 96.5 expected

- January Ifo index was 95.7 points; revised to 96.0

- Expectations 99.2 points

- Prior expectations were 95.2 points; revised to 95.8

- Current conditions 98.6 points

- Prior conditions were 96.1 points; revised to 96.2

That’s a solid beat on estimates as German business morale picks up with the outlook also showing many signs of improvement. Ifo notes that the current results are not influenced by the situation in Ukraine though, and I’d argue it should not be for the most part. If anything else, this continues to underscore the short-lived impact of the omicron variant on the economy.

Remarks by Ifo economist, Klaus Wohlrabe

- German economy expecting an end to COVID-19 crisis

- Ukraine situation however remains a risk factor

- Rising energy prices as a result of Ukraine crisis will be a drag on businesses

- Mood in retail, manufacturing sectors have improved significantly

- But supply bottlenecks continue to be a problem

That pretty much sums up the situation in Europe right now. The omicron impact is one that is short-lived and unlikely to cause another major drag on the economy but inflation and surging price pressures might. That could either come from further escalation in Russia-Ukraine tensions or persistent supply-side issues – or worse, both.