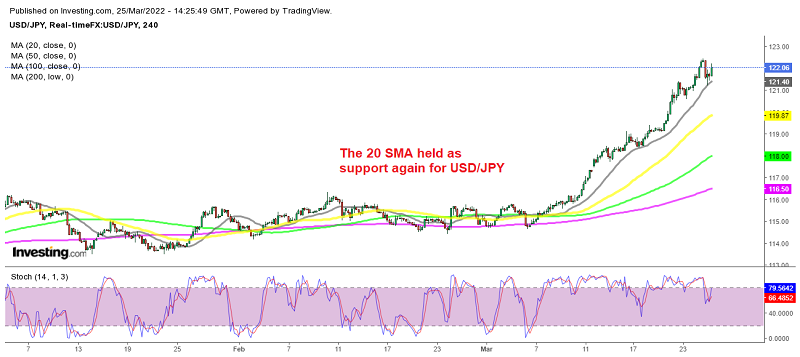

Nothing Can Stop the USD/JPY March, As the FED Turns More Hawkish

USD/JPY started a strong bullish rally at the beginning of this month, which has taken the price around 8 cents higher in such a short period. The JPY should have benefited from the uncertainty as a safe haven currency, but it has been beaten up by market forces since this inflation crisis is hitting everyone and the FED is accelerating the monetary tightening as the hawkish comments below suggest, due to surging inflation.

This has been helping the USD and USD/JPY climb to 122.45 earlier today. We saw a retrace lower, but the 20 SMA (gray) which held as support last week held the retrace again today and we are seeing this pair bounce higher now. The consumer sentiment is holding up well in the US as well during this month, despite the jump in prices which is another positive factor for the USD.

Final revisions to the March sentiment survey

- UMich final March consumer sentiment 59.4 points vs 59.7 expected

- Prelim reading was 59.7 points

- February consumer sentiment was 62.8 points

- Expectations 54.3 points vs 54.4 prelim

- Current conditions 67.2 points vs 67.8 prelim

- 1-year inflation 5.4% points vs 5.4% prelim

- 5 year inflation 3.0% points vs 3.0% prelim

This report was at one time a top-tier slice of economic data but everything is politicized now and so are the responses in this survey. The correlation with actual spending is now nearly nil.

Comments from Williams on a virtual panel

- We are watching inflation expectations very closely

- Medium and longer-run inflation expectations have stayed remarkably stable

- Inflation is at the forefront of all our thinking.

- Financial markets have adjusted expectations with minimal disruption

There’s nothing notable here so far but it’s a reminder to watch inflation closely. Economists at Citigroup now see a monster round of Fed hikes this year. “We now expect the Fed to raise rates 275bp (up from 200bp) in 2022 with 50bp hikes in May, June, July and September and 25bp hikes in October and December, reaching a policy range of 2.75-3.0% at the end of 2022,” they write.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account