EUR/USD Resumes the Decline As Investor Confidence Remains Negative in Europe

EUR/USD has reversed lower again after finding resistance at MAs on the daily chart

EUR/USD turned bearish in the summer last year, as CPI (consumer price index) inflation increased above 5%, which forced the FED to consider it seriously after brushing it under the carpet. They eventually started turning hawkish and now have turned extremely hawkish, with 7 rate hikes expected this year, some of them by 50 basis points (bps).

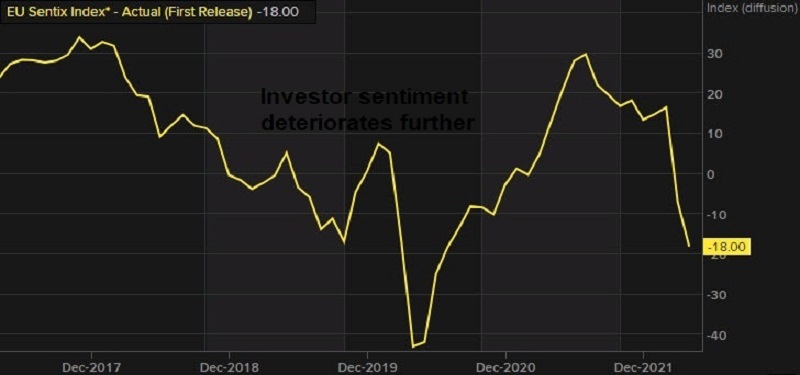

That has helped the USD, forcing EUR/USD to accelerate the decline, especially with the conflict in Ukraine. This has hurt the sentiment in the Eurozone, since Europe is next door to the conflict and it is affected by it since Europe imports many goods from Russia. The Sentix investor confidence was improving in Europe since December as omicron proved to be quite mild, but in March this indicator dived in negative territory again.

EUR/USD Daily Chart – MAs Turn Into Resistance

Let’s see if EUR/USD will push below the 20 SMA now

Eurozone April Sentix Investor Confidence

- April Sentix investor confidence -18.0 points vs -9.2 expected

- merch Sentix investor confidence was -7.0 points

Euro area investor morale fell to the lowest since July 2020 with the current conditions index falling from 7.8 in March to -5.5 in April, the lowest level in a year. Meanwhile, the expectations reading also fell from -20.8 in March to -29.8 in April, the lowest since December 2011.

Recession fears are the main cause as the Russia-Ukraine conflict and the sanctions related are exacerbating underlying weakness in the euro area economy. Sentix notes that:

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account