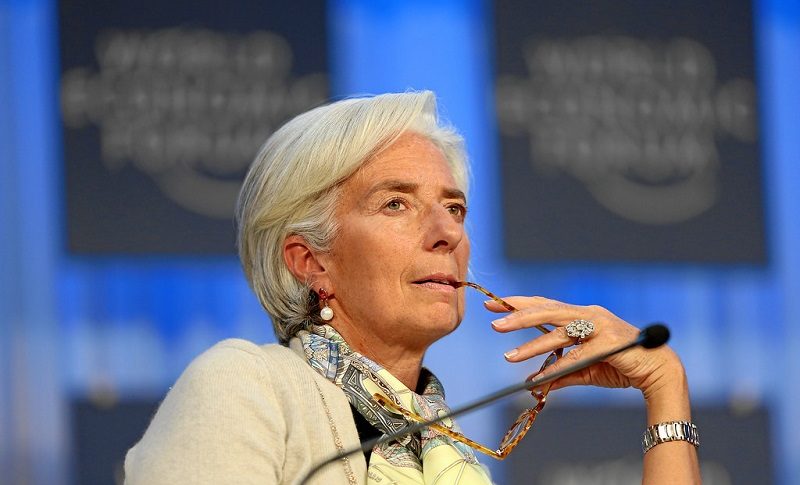

EUR/USD Starting to Reverse Down, As ECB Remains Soft on Rate Hikes

ECB president Lagarde said that rate hikes will be data-dependent, which is negative for the Euro, turning EUR/USD bearish

The momentum on EUR/USD has been bullish since late last week, as the USD has retreated on relief that the FED will not deliver large interest rate hikes after the 75 bps hike we saw in the last meeting. But, the 200 SMA (purple) has been holding as resistance on the H4 chart, at around 1.06, rejecting the price several times, despite being pierced once.

EUR/USD H4 Chart – The 200 SMA Holding As Resistance

The retrace seems complete for EUR/USD

The odds of the FED delivering a 50 bps hike in the next meeting increased after inflation expectations from University of Michigan (UoM). The Fed hit the panic button on the prelim UMich long-term inflation expectations data. The final number is back within the usual range.

It was an indicator that Powell and others specifically cited as a reason to shift. Besides that, we saw a decent rebound in US durable goods orders for May, which indicated that the economy isn’t cooling off that much. FED’s Williams said a while ago that recession is not my base case.

FED Member Williams Commenting on CNBC

- Expects GDP growth of 1% or 1.5% for the year

- We have a path forward to bring inflation down

- There are some downside risks from abroad

- Interest-rate-sensitive sectors of the economy are slowing, like housing

- Economy is strong, financial conditions have tightened

- Expects economy to slow to a point where unemployment rises to 4% but it’s highly uncertain

- My baseline forecast is that we need to get to moderately restrictive territory next year

- It’s reasonable to get to 3.5-4% Fed funds rate

- At our next meeting, 50 or 75 bps will be the debate

- I’m not seeing any sign of a taper tantrum, the bond market is functioning. Watching very closely

Right now the Fed funds curve peaks at 3.60% in March of 2023. On the other hand, the ECB hasn’t started raising interest rates yet. They will start this month, but markets want to see the pace of hikes, and the ECB is not delivering on those expectations, which is negative for the Euro.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account