Strong Bounce in Natural Gas on Heat Wave and Inconsistent Supply

Natural gas prices continue to surge this month, as geopolitics and the heatwave keeps the demand high

In the last several months we have seen some rollercoaster price action in natural gas, as politics keep messing with gas and people’s need to heat or cool, especially now during this heat wave in the US and Europe. Gas prices surged from around $4.50 in March when the conflict in Ukraine started to $9.60s by early June. But, we saw a reversal last month and a crash to $5.30s. This month the demand has returned and gas prices have been on a strong bullish trend.

U.S. gas production continued to hover around 96 Bcf Monday as it did late last week – about 1 Bcf lower from summer highs. Many analysts have estimated that, given the intensity of domestic heat and global demand, the output needs to be sustained at around 97 Bcf to ensure utilities can meet summer demand and inject enough gas into storage for the coming winter.

Global demand for American LNG exports also remains elevated. U.S. liquefied natural gas plants have operated near capacity most of July, save for the temporarily shuttered Freeport LNG facility following a June fire. Demand is strong from Europe, which had until this year largely depended on Russia for its gas supplies. But amid the conflict in Ukraine and Europe’s sanctions on Russia, the gas stream has reduced flows to the continent and threatened to further limit supplies via pipeline.

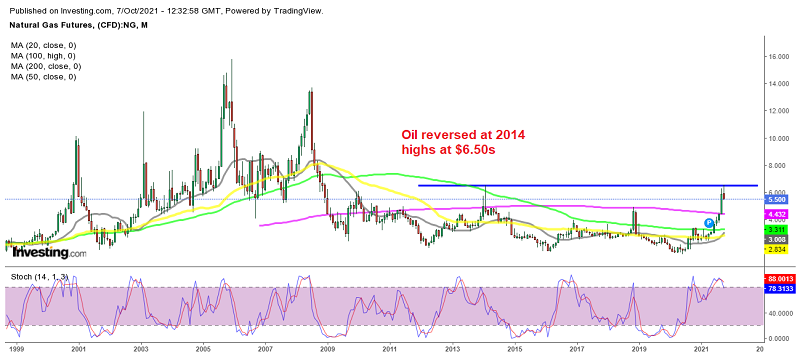

Natural Gas Daily Chart – Heading for the Highs Again?

The 200 SMA held well as support in June

Russian company Gazprom said on Monday that it will cut natural gas shipments from the key Nord Stream pipeline to Germany starting this week. The pipeline’s exports will be cut to 20% of capacity, down from 40%, because of a sanctions-related issue with turbines serving the pipeline, the company said. This has put upward pressure on demand for U.S. LNG. At the same time, as Asian countries such as South Korea and Japan prepare for the winter ahead, they have begun to compete more for American LNG, adding to demand and supporting prices. So, the trend is bullish although let’s see if it can push above $10 this time.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account