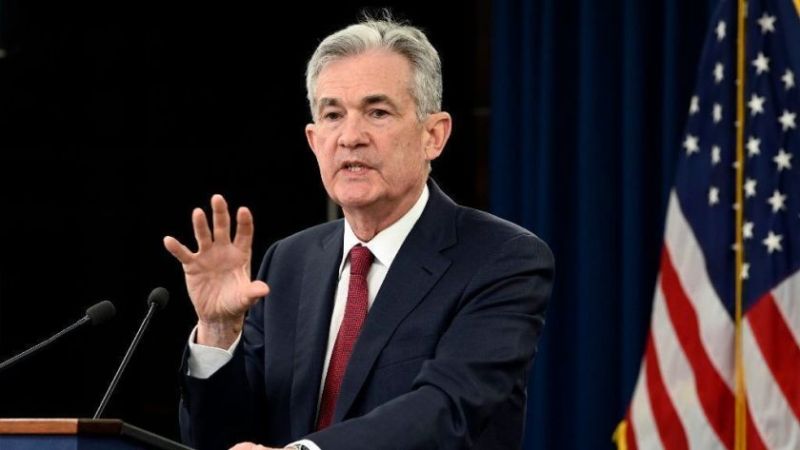

USD Falls and Reverses Higher on Powell’s Comments

After the economic data from the US during the last two weeks, markets were waiting for Jerome Powell’s speech at the Jackson Hole Symposium. The global economy has been weakening and is heading into a recession, with the US economy already there, but recent data showed that the US economy is stable at least. So, anticipations from this speech were high. Odds are in the middle between the FED keeping the pace of rate hikes up, and them softening up in the coming meetings.

EUR/USD H4 Chart – Falling Below the 50 SMA Again

EUR/USD has declined 150 pips after the initial jump on Powell’s comments

Comments from Jerome Powell at the 2022 Jackson Hole symposium.

- July lower inflation numbers are welcome but short of what’s needed by the Fed before being confident in inflation moving down

- Fed is moving policy ‘purposefully’ to a level sufficiently restrictive to return inflation to 2%

- With inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause

- Restoring price stability will take some time, require using central bank’s tools ‘forcefully’

- Reducing inflation likely to require sustained period of below-trend growth

- There will very likely be some softening of labor conditions and some pain to households

- There are unfortunate costs of reducing inflation but failing to restore price stability

- The historical record cautions strongly against prematurely loosening policy

- The longer high inflation continues, the greater the chance it will become entrenched

- Estimates of longer-run neutral are not a place to stop or pause.

- Full speech

What might be getting the market’s attention is the last paragraph of the speech:

We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.

I don’t believe he’s used the word ‘forceful’ before so that could be something, but it’s with the ‘are taking’ language with is past/ongoing rather than ‘will take forceful action’ which is more of a signal.

Aside from that, I don’t see the hawkish bent. It’s what I was looking for, no signal on September and a warning that the Fed won’t U-turn next year. That’s exactly what other Fed officials have been saying. The talk about pain and whatnot is a bit frightening but there’s a lot of nuances there. I don’t think he’s talking about 5% unemployment and ‘below trend’ growth is similarly vague.