USD Runs Higher After Better Manufacturing ISM Figures

US ISM manufacturing was expected to slow down in August but remained stable, which is adding support to the USD

The idea that good news is bad news, has traders reacting to the better-than-expected ISM manufacturing PMI. The index came in better-than-expected 52.8 vs. 52.0. Prices paid declined, employment increased as did new orders. The US jobs report is scheduled for tomorrow with expectations of 295K.

US yields have moved to the upside with the 10 year now up 8 basis points at 3.276%. A new cycle high for the 2 year reached up to 3.53%.

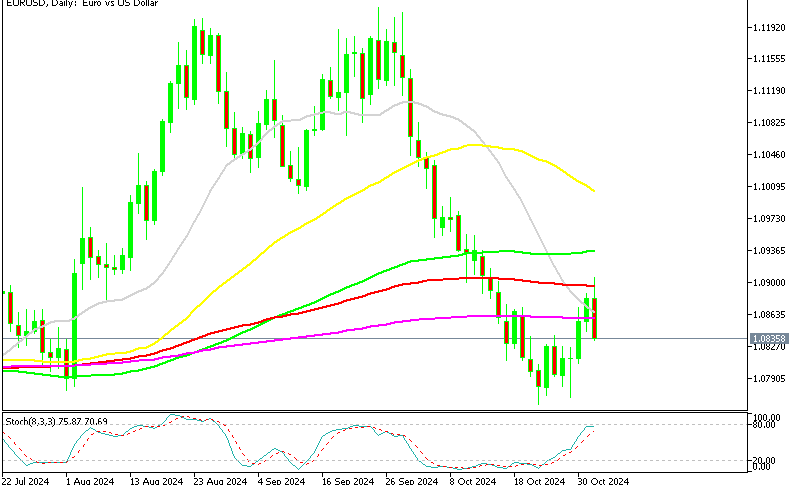

EURUSD is running away (to the downside – dollar bullish) from its 200 hour moving average at 0.99827, and is also back below the July swing low at 0.99515. The next target comes against the low for the week at 0.9913. The lows from last week came in at 0.9908 and 0.9899. The 0.99515 is a close risk followed by the 200 hour MA. Stay below keeps the bears in control.

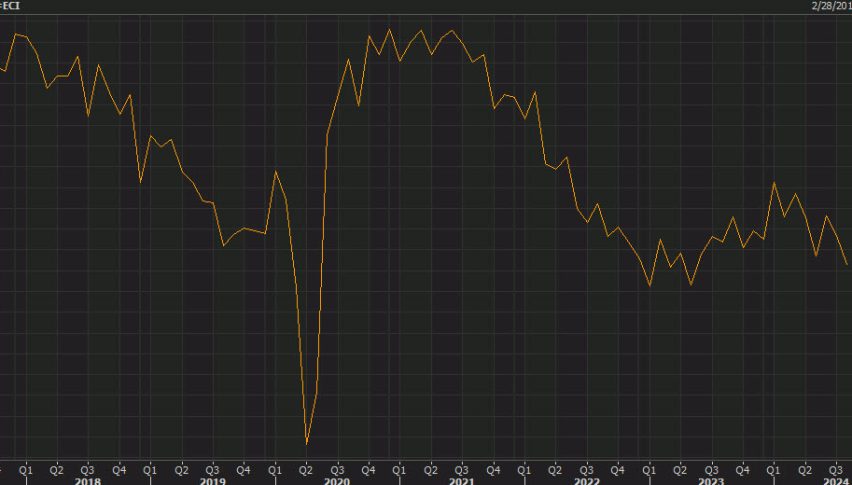

US August 2022 Manufacturing PMI from ISM

- August ISM manufacturing PMI 52.8 points vs 52.0 expected

- July ISM manufacturing was 52.8 points

- Prices paid 52.5 vs 55.5 expected (prior 60.0)

- Production 50.4 vs 53.5 prior

- Employment 54.2 vs 49.9 prior

- New orders 51.3 vs 48.0 prior

This is a big surprise. Lots of good news here. The market is largely ignoring the dip in prices and focusing on the strong headline and that’s lifted the US dollar to new highs on the day. USD/JPY is flirting with 140.00.

Comments in the report:

- “Demand from customers is still strong, but much of that is because there is still fear of not getting product due to constraints. They are stocking up. There will be a reckoning in the market when the music stops, and everyone’s inventories are bloated.” [Computer & Electronic Products]

- “Sales in target business softening month-over-month, down 12 percent by revenue. Inventory days are increasing.” [Chemical Products]

- “Strong sales continue. The impact of the chip shortage is slowing, and the decreasing COVID-19 resurgence in Asia is now affecting production more than chips.” [Transportation Equipment]

- “Supply in most groups is slowly increasing, but demand appears to be outpacing — causing pricing to either stabilize or increase.” [Petroleum & Coal Products]

- “Inventories are far too high, and we are on pins and needles to see how quickly and at what magnitude our busy season begins. We will start seeing that in the next few weeks.” [Food, Beverage & Tobacco Products]

- “Continue to struggle with electronic component shortages. Several smaller machine shops are (manufacturing) the pacing item for our production due to lack of direct labor machinists.” [Machinery]

- “Overall, I have seen much improvement in the availability of raw materials. However, trucking issues continued, and production capacity within some industries remains tight. I have growing concerns that as cement and mineral companies run ‘all out’ to meet demand, we will see more downtime due to maintenance (issues).” [Nonmetallic Mineral Products]

- “Demand is softening; however, we are continuing to produce to replenish inventory.” [Primary Metals]

- “Orders are still strong through the end of the year, but there is a feeling that customers may start pulling back on orders, either cancelling them or pushing them into 2023.” [Plastics & Rubber Products]

- “Business conditions are good, and demand is strong. Securing enough raw material supply to keep up is still a challenge.” [Miscellaneous Manufacturing]

There isn’t much to fret about in those comments and the thinking is that it’s a green light for the Fed to tighten more aggressively. What really stands out though is how much better the US economy is doing than elsewhere. That’s the flashing signal for USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account