USD/CAD Bounces As Inflation Cools in Canada

USD/CAD has bounced higher today off MAs, s inflation started to cool in Canada in August

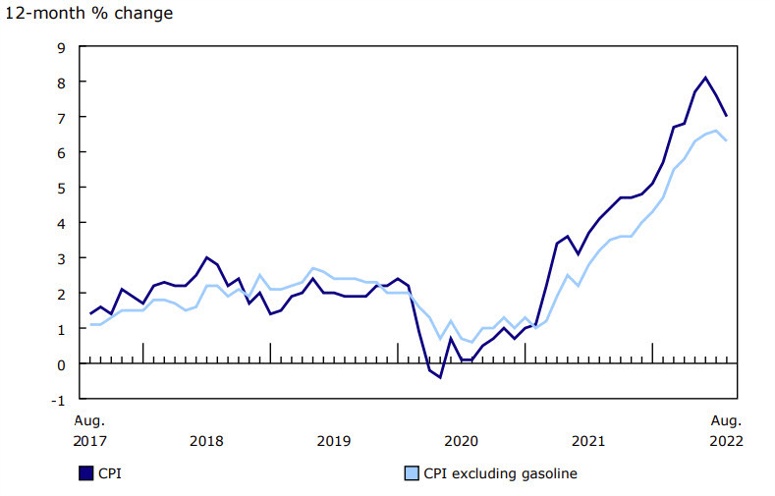

Similar inflation dynamics are unfolding in Canada and the US, so the two CPI reports are a worthwhile crosscheck on each other. The US report last week was higher than anticipated, particularly on the core side. Today, Canadian CPI is forecast to fall 0.1% m/m while the y/y figure is expected to decline to 7.3% from 7.6%. The core ‘common’ measure is the only one of the three with a consensus estimate and it’s at 5.6% from 5.5%.

Canadian August 2022 consumer price index data

- Canada August CPI YoY 7.0% vs 7.3% expected

- Prior was 7.6%

- CPI August MoM -0.3% vs -0.1% expected

- Prior CPI MoM reading was +0.1%

- ore CPI Ex-gasoline YoY +6.3% vs +6.6% prior

- Gasoline prices -9.6% vs -9.2% in July

- Average hourly wages +5.4%

- Energy prices YoY +% vs +28.0% prior

- Food +10.8% vs +7.6% y/y prior

- Shelter costs +6.6% vs +7.0% y/y prior

- Services +5.5% y/y vs +5.7% prior

- Full report

Core measures:

- BOC core 5.8% vs 6.1% prior

- BOC core m/m 0.0% vs +0.5% prior

- Median 4.8% vs 5.0% prior

- Trim 5.2% vs 5.4% prior

- Common 5.7% vs 5.6% expected (5.5% prior)

USD/CAD H1 Chart – MAs Holding As Support

This is an early sign of cooling inflation from the first central bank to hike. The internals of the report look consistent with the headline, though the uptick in CPI common is notable. On net, there was negative inflation in August and the core was flat. Food is a big problem in Canada and globally though, especially in places where people can’t afford to pay more.

The Bank of Canada is widely expected to hike 50 bps on October 26 to lift the rate to 3.75%. From there, we could see the central bank indicate perhaps another 25 bps and then some time on the sidelines.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account