Gold Sideways Trading Continues – FOMC Weighs

The gold price is perplexed after gyrating in a larger range following the Federal Reserve's pronouncement of monetary policy (Fed).

The gold price is perplexed after gyrating in a larger range following the Federal Reserve’s pronouncement of monetary policy (Fed). After touching a two-year low of $1,654.50, the precious metal rebounded strongly. However, the upside appears to be limited to roughly $1,685.00, which has pushed the yellow metal back into the woods.

The Federal Reserve’s (Fed) aim of taming ultra-hot inflation is mostly harming corporations. Higher borrowing requirements are driving them to postpone current expansion plans and reduce investment in profitable possibilities. As a result, growth expectations and, eventually, job creation are falling precipitously. Furthermore, the housing sector is suffering as rising loan rates result in larger monthly installments, causing people to postpone their home-purchase plans.

In the meantime, the US dollar index (DXY) is seeking to reclaim its two-decade high of 111.81 ahead of the S&P Global PMI data. According to preliminary projections, the Manufacturing PMI will fall to 51.1 from 51.5 in the previous edition. While the services PMI will rise to 45.0 from 43.7 previously.

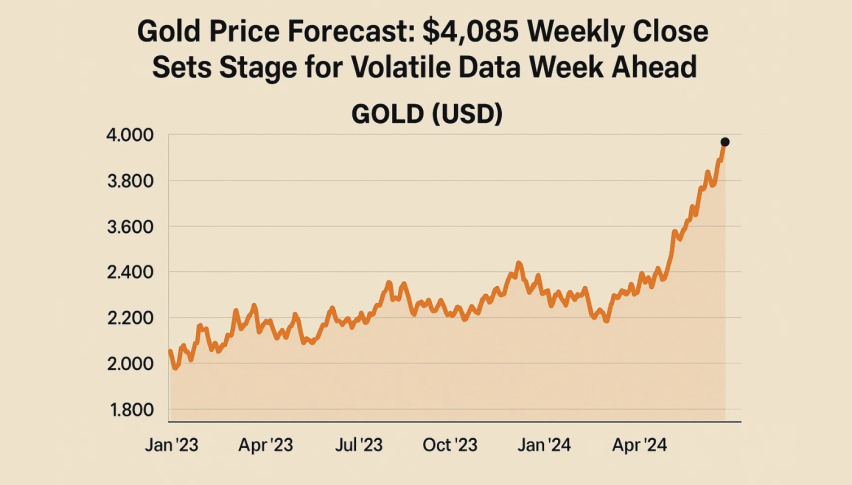

Gold Technical Outlook

The gold price continues to oscillate around the bearish channel’s resistance and maintains its stability below it, falling under constant negative pressure from the EMA50, preparing to resume the bearish wave and travel towards 1644.00 as the primary negative station.

Breaking 1665.00 will facilitate the objective of obtaining the desired targets, reminding you that it is critical to maintaining the indicated bearish wave below 1680.00. Today’s trading range is likely to be between 1650.00 support and 1685.00 resistance.

Today’s projected trend: Bearish

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account